Contents

Investors make money on growth stocks just as well as they do value investing. The reason why you always need to compare stocks within a sector is that those fundamental metrics vary greatly depending on the sector. A low P/E ratio for stocks in the technology sector would be very high compared to the average in the financials. Price-to-sales ratio is the stock’s price divided by the sales per share generated by the company. A lot of accounting gimmicks go into creating earnings so I like to use sales as a value measure because it’s more difficult to manipulate by management. Specifically, consider what’s driving the company’s share price to be lower than the competition and how the price is trending.

Her articles have appeared on platforms like MSN, Yahoo and PopSugar. Undervalued stocks are often traded below their believed market value. Here’s how to find them, and what makes them attractive to investors. To verify if this approach actually works, we took the top 30 holdings of the DSP Value Fund and put those stocks in a stock screener. We found that 24 of the 30 companies had delivered a 5 year ROE in excess of 15%. Additionally, 29 of the 30 companies put into the stock screener had delivered a 5 year ROE of at least 10%.

Many stocks are undervalued because the participants in the market do not understand them. However, many people believe market participants understand what they are trading. Thus, most people believe the Green Lumber Fallacy and think the market is an accurate pricing mechanism. The key criteria are Return on Equity, Price to Book, Price to Free Cashflow, and Return on Invested Capital.

The results are sure to provide an indication of the fund management team’s convictions related to finding undervalued stocks. The third step when selecting an undervalued stock is to identify good companies that are available at a discount. Even if a company is well-managed, makes a great product, and has a great reputation, it might not be suitable as a value investment. One reason for this might be due to the high price of its shares. A higher share price would increase the initial investment required and result in higher risk for the investor.

Is It A Good Time To Invest In Nifty 50 Index Fund?

However, I think that including too many indicators in a stock screen might not be a good idea- the more you add the more convoluted the approach gets. I’ve included 3 very popular and 11 things java programmers should learn in 2021 value-oriented stock screens here below from of the world’s best investors. Check out this step-by-step guide to learn how to scan for the best momentum stocks every day with Scanz.

As per prevailing interest rates in India, companies that have delivered ROE of 15% or higher in the long term are considered to be good companies. Members should be aware that investment markets have inherent risks, and past performance does not assure future results. Investor Junkie has advertising relationships https://traderevolution.net/ with some of the offers listed on this website. Investor Junkie does attempt to take a reasonable and good faith approach to maintaining objectivity towards providing referrals that are in the best interest of readers. Investor Junkie strives to keep its information accurate and up to date.

Most Undervalued Quality Stocks To Buy According To Hedge Funds

Benjamin Graham advised investors to look for stocks in companies with values the market could not see. For example, a retailer with a low stock price but extensive real estate holdings. The retailer’s business might lose money, but the property its stores sit on could be valuable. Price to Tangible Book Value is a better way of finding undervalued stocks than the Price to Book calculation. Price to Tangible Book compares a stock’s market value to the value of total assets, less total liabilities, and intangibles. This metric is the most important company valuation metric, as it is the final output of a detailed discounted cash flow analysis.

- Investors were terrified of market conditions and large oil companies hit valuations that were not reflective of their underlying assets.

- You cant look strictly at the ratio itself but must take a close look at the reasons why.

- Consider talking to your financial advisor about whether value investing is the right strategy for you and how to employ it in your portfolio.

- PE Ratio, or price-to-earnings ratio, is one of the most common valuation numbers.

- But if a company’s dividend is much greater than the S&P 500’s average, you may need to research other financials of the company to understand if it’s stable.

How to be a successful investor — investment insights, strategies, and education on stocks, ETFs, crypto, real estate, and more. She graduated from King’s College London with a master’s in environment, politics, and globalization, and has over 10 years of writing experience. Her journey to finance writing started with a goal to learn as much as she could about how to attain financial freedom and share information with others about how to do it, too. This led her to Debt.com where she covered topics relating to mortgages, debt and credit.

It’s an approach involving buying stock in solid companies that are lower priced compared to their major competitors. When the market eventually discovers the company’s undervalued, the returns can be spectacular. That means the stocks mentioned in the article are the most popular undervalued large-cap stocks among the elite hedge funds operating in financial markets. The list is arranged in ascending order of the number of hedge fund holders in each firm. To find undervalued stocks, you can use established financial ratios such as discounted cash flow, the margin of safety, PEG, price to book, or the price to Graham number. Each ratio provides a unique insight into the company’s value to determine if it is undervalued.

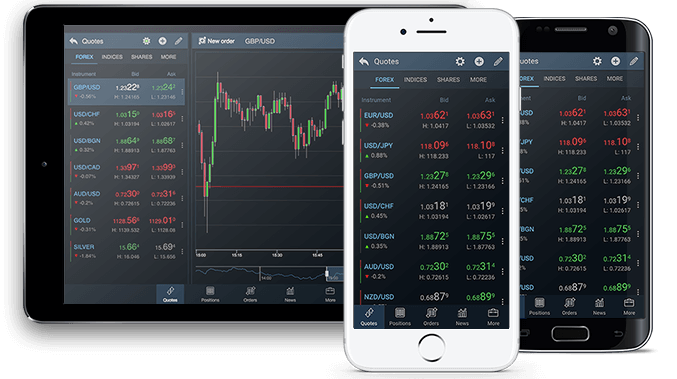

The first step when identifying undervalued stocks is to use a stock screener. A stock screener is a set of tools that allow investors to quickly sort through a large number of companies according to a few pre-defined criteria. Any investor would be thrilled to find a stock that’s on the way up in price, but it’s not always a simple or easy process. While you can look at analyst ratings, news reports and other sources, one of the best ways to identify undervalued stocks is using a stock screener.

Low Market-to-Book Ratio

If the current stock price is $50 and the EPS is 10, divide 50 by 10. Fast forward to 2022, and Tesla was trading above $600 a share. So investors who bought in when the price was around $4 a share reaped the benefits of undervalued stocks that end up doing well in the long-term. The P/B Ratio can vary significantly for companies within the same sector. For example, among tech stocks in India, the P/B Ratio can range from 4 times to 20 times the sector P/B Ratio. Defining expensive and inexpensive stocks based on P/B Ratio ensures that value investors do not get carried away by chasing the most popular names in a specific sector.

If you’re trying to screen which stocks to invest in for value, numerous online tools can help. These tools can help you view key ratios and financial information for different companies at a glance for easy comparisons. To effectively and efficiently find undervalued stocks, you will need to use a stock screener to sort, filter, and research potential value investments. Many free stock screeners are available online, but only a few are tailored specifically to find value stocks.

Not only are companies going to become undervalued from world events and earnings news, but there are also cyclical fluctuations in the market. Some companies are going to outperform others during different stages of the economy—this may be what is happening with casino stocks. This is one of the reasons esp8285 vs esp8266 oil companies crashed in the early days of the pandemic. Investors were terrified of market conditions and large oil companies hit valuations that were not reflective of their underlying assets. In some industries, the P/E may be higher than in other industries, but the stock may still be undervalued.

However, there are a few important things to keep in mind when approaching these stocks. On the contrary, when you buy an undervalued stock, the odds are better. Even if your analysis is wrong, there are chances that the market will be even more wrong and push the price higher. You also start closer to 0, thus your risk-to-reward will be better.

Ironically, people may be dropping value stocks at exactly the wrong time. Current ratio.The current ratio is commonly used to assess a company’s financial health. It’s simply a company’s assets divided by its liabilities, and it’s a way to measure how easily a company can keep up with its debt obligations.

However, this short-term increase in profitability will come at the cost of the company’s long-term stability. This, in turn, makes the company’s stock unsuitable as a value investment. This is particularly useful in today’s somewhat overvalued make . When the broad market is no longer cheap by metrics such as the Shiller P/E, a real search for value is necessary.

Finding undervalued stocks with Stock Rover

Two of the most popular models are discounted cash flow and dividend discount models. These are also known as “absolute value” models, as they take only the financial data from the company. The price-to-book ratio is a financial indicator that compares the market value of the company to its book value. While high growth sectors like healthcare or technology can mandate higher ratios other sectors like financials will have much lower ratios.

How To Find Undervalued Stocks Like a Pro Value Investor

If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. The assets under management of index funds stood at Rs 1.73 lakh crore in FY21-22, up by 197% as compared to Rs 58,173 crore in…

For every earnings per share that APPL makes, investors are willing to pay 36.72 times that amount to hold the company. For the past 12 months, Apple has made approximately $3.69 per share for 16.79 billion shares, and investors are buying shares at around $135. To start researching stocks you will need to learn how to evaluate companies and learn about financial metrics. You will have to determine the health of the company, the competency of the institution’s management, and how much money a company makes. This ratio compares the current price of stocks with the book value per share of the stock.

To determine undervalued stocks, start by looking up the stock on a trading website, like Morningstar or Yahoo Finance. Look for stocks with a low price to earnings ratio, which compares the current price of the stock with the earnings made from each share. If you see a low ratio, this indicates that the stock is cheaper. Additionally, choose companies with a debt to asset ratio of 1 in 10 or less, which means that they have more assets than they have debt. This is a sign of a strong company and a good stock, so take note of it and consider buying.

To make above-average returns, you have to break away from the pack. Oftentimes, when a company is seeing a sell-off due to news or market conditions, traders will overcorrect. This means that the true price of the stock should be different than what investors are trading at. They push the asset outside of the normal, sustainable threshold—and here is the opportunity for savvy traders.

Growth rate, because a solid company with 0% growth can still be an interesting buy if the price is right. Cash per Share greatly contributes to the overall health of a company. If a company is able to liquidate assets quickly to adapt to market changes, it will be better equipped when the waters get choppy. Like all of our other financial metrics, not one thing is going to make or break the stock. When you combine the metrics, they will help you understand the larger story.

Dividends allow you to make a small profit while you wait for your undervalued stocks to become overvalued stocks. Look for stocks that pay steady or increasing dividends each year.To see if a stock pays dividends, look on their stock profile for dividend yields. If the company has a dividend yield posted, then it means that they pay out dividends. The current ratio compares the assets of a company to its liabilities. A 1.5 shows that the company has more assets than they do liabilities. Most stock websites will list the current ratio on the stock’s balance sheet.

If all of the company’s revenue is tied up in repaying debts, then they aren’t going to be able to grow. Be warned, some companies will raise their dividends just for the sake of attracting new investors. This can inflate the price of a stock when the underlying company is trash. You can avoid companies that do this by looking for dividend payers that have had steady payments and increases over a long period of time. Dividend yield percent is another easy way to narrow down your search for undervalued companies.

In particular, market players cannot see or appreciate many of the attributes that enable companies to make money. For example, few investors understood the potential value of e-commerce like Jeff Bezos did. A price to Graham Number less than 1 suggests a company is undervalued.