So, it is possible that the opening price on a Sunday evening will be different from the closing price on the previous Friday night https://www.glassdoor.com/Reviews/Dotbig-Reviews-E6535232.htm – resulting in a gap. It’s important to remember that margin requirements vary according to currency pair and market conditions.

- The variables that drive forex trading and changes in exchange rates are different from those that drive stock prices.

- Forex traders enjoy the utmost in liquidy, which promotes tight spreads, regular volatilities and rock-bottom pricing.

- The exotic pairs have one major currency and one minor, such as EURTRY, USDNOK and many more.

- The advantage for the trader is that futures contracts are standardized and cleared by a central authority.

- CFDs are leveraged products, which enable you to open a position for a just a fraction of the full value of the trade.

- Each bar chart represents one day of trading and contains the opening price, highest price, lowest price, and closing price for a trade.

If the price is moving up on EUR/USD, it means the euro is moving higher relative to the U.S dollar. If the price on the chart is falling, then the euro is declining in value relative to the dollar. At any time, the demand for a certain currency will push it either up or down in value relative to other currencies. Here are some basics about the currency market so you can take the next step and start forex trading. The U.S. dollar is by far the most popular currency in forex transactions, accounting for $5.8 trillion of the average daily volume in April 2019, the BIS found. This series of 10 articles starts with an essential guide on the basics of foreign currency trading.

Famous Currency Symbol And Pair

Margin isn’t a direct cost to you, but it has a significant impact on the affordability of your trade. The most basic forms of forex trades are a long trade and a short trade. In a long trade, the trader is betting that the currency price will increase in the future and they can profit from it. A short trade consists of a https://en.wikipedia.org/wiki/Bank_of_the_United_States bet that the currency pair’s price will decrease in the future. Traders can also use trading strategies based on technical analysis, such as breakout and moving average, to fine-tune their approach to trading. For beginner traders, it is a good idea to set up a micro forex trading account with low capital requirements.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning dotbig review editors and reporters create honest and accurate content to help you make the right financial decisions.

How Do I Get Started With Forex Trading?

This is because the USD and the GBP were exchanged through a submarine communications cable. To read more about the events and factors that move Forex pairs, click here. These tools and many others allow you to trade comfortably and know that AvaTrade has your back. Everything we provide is to the highest possible level, and we go dotbig to great measures to constantly innovate and improve them for you. Margin Account-Account which is used to hold investor’s deposited money for FOREX trading. Lot-It represents the minimum quantity which can be traded in any given instrument. Floating Leverage-Leverage that changes depending on the total size of open positions.

That size and scope creates unique challenges regarding market regulation. The most common chart types are bar charts and candlestick charts. Although these two chart types https://www.google.com/maps/place/DotBig+Europe/@48.7801721,9.1729771,17z/data=!3m1!4b1!4m5!3m4!1s0x4799db9accab4263:0xb70bef4a7ffc4502!8m2!3d48.7801721!4d9.1751659 look quite different, they are very similar in the information they provide. Take our personality quiz to find out what type of trader you are and about your strengths.

How Gdp Data Helps Forex Traders Consider The Bigger Picture

They are visually more appealing and easier to read than the chart types described above. A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white. A French tourist in Egypt can’t pay in euros to see the pyramids because it’s not the locally accepted currency. The tourist has to exchange the euros for the local currency, in this case https://en.wikipedia.org/wiki/Bank_of_the_United_States the Egyptian pound, at the current exchange rate. Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps. To put this into perspective, the U.S. stock market trades around $257 billion a day; quite a large sum, but only a fraction of what forex trades. CFDs are leveraged products, which enable you to open a position for a just a fraction of the full value of the trade.

What Is Foreign Exchange?

IG offers competitive spreads of 0.8 pips for EUR/USD and USD/JPY, and 1 pip on GBP/USD, AUD/USD and EUR/GBP. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Investopedia does not include all offers available in the marketplace. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in oureditorial policy.

What Is A Pip In Forex Trading?

A vast majority of trade activity in the forex market occurs between institutional traders, such as people who work for banks, fund managers and multinational corporations. These traders don’t necessarily intend to take physical possession of the currencies themselves; they may simply be speculating about or hedging against future exchange rate fluctuations. Approximately $5 trillion worth of https://www.google.com/maps/place/DotBig+Europe/@48.7801721,9.1729771,17z/data=!3m1!4b1!4m5!3m4!1s0x4799db9accab4263:0xb70bef4a7ffc4502!8m2!3d48.7801721!4d9.1751659 forex transactions take place daily, which is an average of $220 billion per hour. The market is largely made up of institutions, corporations, governments and currency speculators. Speculation makes up roughly 90% of trading volume, and a large majority of this is concentrated on the US dollar, euro and yen. Since the market is unregulated, fees and commissions vary widely among brokers.

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00  Amisol Gold (Inj.) 500ml

2 × ৳ 401.00

Amisol Gold (Inj.) 500ml

2 × ৳ 401.00  Turboclav (Tab) 500mg

1 × ৳ 44.00

Turboclav (Tab) 500mg

1 × ৳ 44.00  Twinkel (Diaper)-L 4Pcs

1 × ৳ 125.00

Twinkel (Diaper)-L 4Pcs

1 × ৳ 125.00  Closeup | 100 g

3 × ৳ 110.00

Closeup | 100 g

3 × ৳ 110.00  Twinkel (Diaper)-M 4Pcs

1 × ৳ 120.00

Twinkel (Diaper)-M 4Pcs

1 × ৳ 120.00  Tusca (Syp) 100mg

1 × ৳ 65.00

Tusca (Syp) 100mg

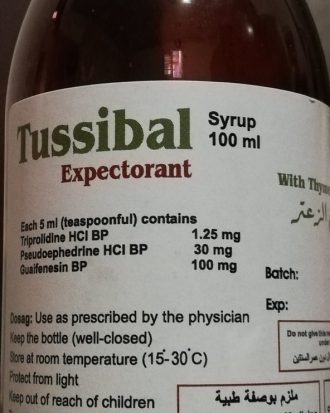

1 × ৳ 65.00  Tussibic (Syp) 100ml

1 × ৳ 80.00

Tussibic (Syp) 100ml

1 × ৳ 80.00  Win Boost (Pen)

1 × ৳ 10.00

Win Boost (Pen)

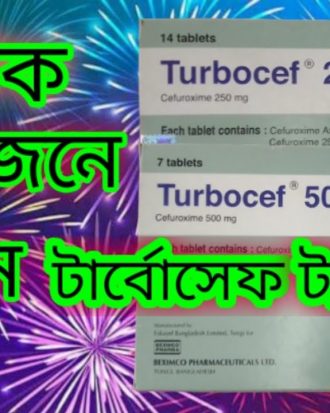

1 × ৳ 10.00  Turbocef (Tab) 500mg

1 × ৳ 45.00

Turbocef (Tab) 500mg

1 × ৳ 45.00  Turboclav (Tab) 250mg

1 × ৳ 30.00

Turboclav (Tab) 250mg

1 × ৳ 30.00  Carex Classic Condoms | 3 pieces

1 × ৳ 35.00

Carex Classic Condoms | 3 pieces

1 × ৳ 35.00  Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00  Amilin (Tab) 25mg

1 × ৳ 1.75

Amilin (Tab) 25mg

1 × ৳ 1.75  Migrex (Tab) 200mg

1 × ৳ 10.00

Migrex (Tab) 200mg

1 × ৳ 10.00  Tusca Plus (Syp) 100ml

1 × ৳ 80.00

Tusca Plus (Syp) 100ml

1 × ৳ 80.00  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00  Adelax (Tab)

1 × ৳ 5.02

Adelax (Tab)

1 × ৳ 5.02  Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00  Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00