Lender out-of the united states car loan position sign on

Simple payday loans online lead bank

Are you looking for a different sort of family or flat? In this case, you then is always to see obtaining home financing. The good thing is you never need to worry about having bad credit given that loan providers are able to give currency so you’re able to borrowers who possess poor credit scores. A home loan is a kind of financial obligation protected facing a residential property. This means, you borrow money from a lender (the financial institution) and you will invest in pay back the amount including attention throughout the years. This is why you will need to repay the principal and you can interest every month up until the mortgage has been paid off. There are a few sort of mortgage loans, such as repaired rate, variable rates, and adjustable price. Each kind has the advantages and disadvantages. Such as for instance, a predetermined rates mortgage always offers all the way down prices than simply a varying speed financial. While doing so, an adjustable price mortgage you will render better autonomy since you can also be love to protected a minimal rate to possess a certain period of time.

Payday loans corsicana texas

Payday loan was temporary payday loans that is certainly beneficial when you really need a little extra financing. They are also called payday loans or paycheck enhances. Pay day loan is actually a variety of unsecured personal loan which allows borrowers in order to acquire a certain amount of money from a lender inside a certain time frame. The eye costs charged throughout these types of funds are very different depending towards the lender. You should simply make an application for a quick payday loan for many who certainly need to have the currency. If not pay back the loan on time, you’ll incur even more penalties and fees.

Are you looking for ways to borrow a little extra dollars without having to read a bank otherwise borrowing from the bank relationship? Therefore, you then should think about applying for an instant payday loan which have an excellent Prepaid card. These types of loan is well-accepted as they render individuals fast access in order to loans. Cash advance is loans that normally include $100-$1500. They usually require no security and generally are designed to give instantaneous monetary recovery to those who are up against unanticipated expenses. Such funds are called cash advances, income improves, or deferred deposit financing. A prepaid service debit card can be used to receive a pay day financing. The newest debtor just deposits money into the their particular prepaid card account. Up coming, he/she spends the newest credit so you can withdraw cash within ATMs. Because cash is taken, the fresh new debtor will pay back the loan also desire.

Looking for ways to loans the startup otherwise expansion? In this case, then you definitely should consider obtaining a company financing. Indeed, these fund are becoming more common than before. Small businesses tend to be unable to supply money because they don’t enjoys good credit score. Consequently financial institutions are not prepared to provide them currency. For this reason advertisers turn to choice money possibilities such as microloans. There have been two a means to receive a small business financing: as a result of a bank otherwise using an exclusive lender. The previous alternative usually means a good credit score, whereas the second choice allows you to pertain even although you has bad credit.

Education loan loans was an issue recently. The typical scholar borrower today owes $37,172, depending on the installment loans North Carolina Government Put aside Lender of new York. When you find yourself incapable of pay their student loans, refinancing may be the answer. Student loan loans is a significant issue in the usa today. Depending on the Individual Economic Safeguards Agency (CFPB), more than 40 million Americans are obligated to pay more $step 1 trillion inside the student loan debt. Refinancing your student education loans is a great way to down your payments if you don’t eliminate them completely. Refinancing enables you to sign up for a unique financing at a good all the way down interest. This reduces your own full amount owed, and you will renders paying your own finance smoother.

Boost 3X More Stamina Jar | 400 g

3 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

3 × ৳ 390.00  Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00  Closeup | 100 g

2 × ৳ 110.00

Closeup | 100 g

2 × ৳ 110.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clear Complete Active Care | 180 ml

3 × ৳ 220.00

Clear Complete Active Care | 180 ml

3 × ৳ 220.00  Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00  Destin (Syp) 60ml

1 × ৳ 25.00

Destin (Syp) 60ml

1 × ৳ 25.00  Carex Classic Condoms | 3 pieces

1 × ৳ 35.00

Carex Classic Condoms | 3 pieces

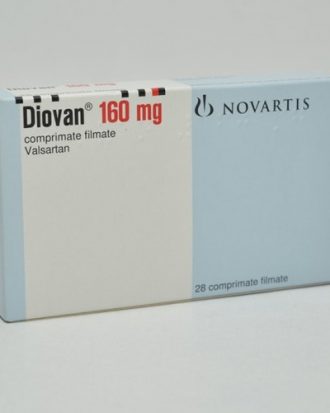

1 × ৳ 35.00  Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00