If you Need Money from Your 401(k) to spend Personal debt?

If you were having fun with a workplace retirement bundle such as for example a 401(k) – and you will become, when deciding to take benefit of material focus and one employer matches readily available – you can at some point finish taking a look at the areas of cash and curious if you should use some of they to deal with newest economic facts unlike saving all of it for the old age. Anyone works together with monetary problems will eventually, and is also readable to consider one to bunch out-of untouched money and you will imagine you ought to just search for the today. Whenever you are you’ll discover a few examples in which it a beneficial good clear idea, if the its possible to get rid of raiding their 401(k), it is preferable so that they stand, many different grounds – told me lower than. When you are experiencing monetary factors instant payday loans Ohio and need let, think looking a financial coach.

Are you presently Permitted Withdraw Money from The 401(k) to blow Personal debt?

First, you are going to need to determine whether you can utilize use your 401(k) deals to invest obligations. Your own package administrator additionally the Irs assistance are perfect resources but generally, 401(k) distributions are permitted if the:

- You’re able to many years 59.5

- You pass away, getting disabled otherwise are if not taken in the workforce

- Your boss terminates their bundle and you may will not change it that have other

- New shipments is related to a financial hardship

You to definitely past a person is important because not totally all businesses make it difficulty distributions from a beneficial 401(k). Even in the event their package really does enable it to be adversity withdrawals, you should reveal that the money tend to target an immediate and you can big financial need. Detailed with such things as:

- Paying scientific expenses yourself, your wife otherwise their dependents

- Purchasing a principal house

- Expenses tuition, academic charge or room and panel on your own, mate or dependents

- To stop eviction otherwise foreclosures

- Funeral expenditures

Keep in mind that the manager varies. Though your boss lets a difficulty shipments, they may not admit every one of these issues. Usually, you simply will not have the ability to subscribe the plan within half dozen weeks from delivering a difficulty detachment.

Using a great 401(k) Financing to settle Debt

If you are not qualified to receive an adversity distribution and would like to steer clear of the firm income tax charges for the cashing out your bundle, you have a third choice. Specific companies allow plan people in order to acquire regarding by themselves playing with an effective 401(k) financing.

Such money commonly carry a lower life expectancy interest than just alternative options, aren’t taxed plus don’t impact your credit rating. Even although you need to pay a keen origination fee, the price tag could be lower than the brand new tax charges you’ll deal with out of an earlier withdrawal. Yet there are some disadvantages to help you a good 401(k) mortgage.

Many you could borrow on their 401(k) is 50% of vested account balance, otherwise $fifty,100, any kind of is quicker. To phrase it differently, you can not simply pull your entire advancing years savings aside. You will get more than one financing aside at a time, nevertheless complete amount owed cannot be more than the latest limitation. Very 401(k) funds need to be paid back within five years. If you are married, your boss need your wife to help you agree to the mortgage.

Together with, your employer could possibly get briefly suspend the brand new efforts on bundle up to you paid off the loan. That means that while you are repaying exactly what you’ve lent, you aren’t incorporating other things towards the equilibrium. The cash you withdraw and doesn’t have a way to work with regarding compounding interest, that will stunt their nest egg’s development. Of course your separate from the employer before financing is actually repaid, the newest Internal revenue service requires you only pay the rest financing balance in full contained in this 60 or 3 months.

Possible Penalties having Withdrawing From your 401(k) Very early

Senior years levels such as for instance 401(k)s, 403(b)s and other equivalent options are tax-gurus profile. This is why the newest Irs also provides their people unique tax masters so you’re able to save your self to own old age. As a result of such advantages, the fresh Irs is quite stingy along with its withdrawal legislation.

For instance, a great ten% early detachment punishment typically enforce when you take funds from a good 401(k) or other certified later years bundle just before getting together with decades 59.5. This can genuinely have really harmful consequences to your much time-term fitness of retirement coupons.

Very early distributions are also susceptible to normal taxes outside of the 10% penalty. Depending on the tax supports you’re in, the combination out of a hefty punishment and you may regular taxes could run you for a while.

That it punishment disease is exactly as to why 401(k) finance is a far greater solution than simply a straight-up detachment. It relies on you truly having the ability to pay brand new mortgage as well, although. However, otherwise pay it back in time, the entire amount gets a nonexempt delivery subject to income tax plus the ten% punishment.

Delivering Money Out-of an excellent 401(k) Pay Debt: Can it Make sense?

To decide if withdrawing from your 401(k) is practical, crunch the newest numberspare the interest rate in your loans to your income tax charges you’ll face. High rates of interest to the high loans may necessitate outlandish measures. If you are considering a good 401(k) mortgage, definitely features a disciplined monetary package. 401(k) money can be an effective selection for eliminating higher-interest financial obligation, nevertheless they can invariably cost you.

Tell the truth regarding where you stand, also. When you have a fairly higher carrying out equilibrium, utilizing your package will most likely not make a big difference from the long term. When you find yourself currently about towards the saving, not, bringing money from their 401(k) you will do a giant problem been old-age. There’s also an emotional element in order to borrowing against your retirement. Once you tap that cash, it could be enticing to get it done again.

Realization

Using your 401(k) since a piggy bank may well not appear to be such as for example a bad material. Based your balance, you can eliminate any financial obligation at the same time. However, delivering currency out of your 401(k) to expend financial obligation may lead to taxation penalties and you can put-off advancing years. Worse, you could put your enough time-label monetary health in danger. Think about your choice very carefully and make certain you know the new effects regarding for every single before deciding.

Closeup | 100 g

3 × ৳ 110.00

Closeup | 100 g

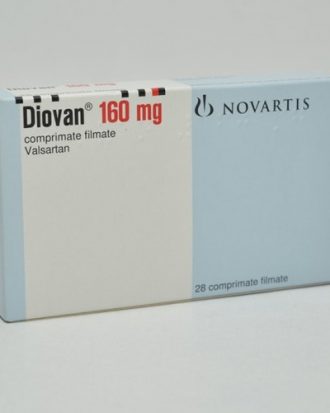

3 × ৳ 110.00  Diovan (Tab) 160mg

3 × ৳ 57.00

Diovan (Tab) 160mg

3 × ৳ 57.00  Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00  Maggi Masala Blast 252gm

1 × ৳ 70.00

Maggi Masala Blast 252gm

1 × ৳ 70.00  Abecab (Tab) 5/40mg

1 × ৳ 18.00

Abecab (Tab) 5/40mg

1 × ৳ 18.00  Mederma Advanced Plus (Scar Gel) 10gm

2 × ৳ 920.00

Mederma Advanced Plus (Scar Gel) 10gm

2 × ৳ 920.00  Carex Classic Condoms | 3 pieces

1 × ৳ 35.00

Carex Classic Condoms | 3 pieces

1 × ৳ 35.00  Alve (Tab) 60mg

1 × ৳ 5.00

Alve (Tab) 60mg

1 × ৳ 5.00  Clear Men Anti-Dandruff | 330 ml

2 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

2 × ৳ 450.00