You have available cash flow, however, you’re not sure if it should go towards the brand new fund

Most other scholar youngsters have recognized some degree of money disperse every month which they have to set on their financial goals, but they aren’t certain that its funds are going to be its most readily useful top priority. Possibly they think they may additionally use certain additional dollars deals on hand otherwise is actually enthusiastic about investing.

For as long as the latest pupil possess a suitable disaster money and you will/or dollars to have brief-name purchasing and no highest-interest rate loans, placing the cash flow toward both your debt payment otherwise much time-identity expenses is an excellent selection. What type is released at the top should be determined centered on a couple no. 1 points: the newest math as well as your personal spirits.

The brand new mathematics: Compare the speed in your loans towards the average annual price from get back you expect on your own investment. If for example the interest is significantly less than the questioned average yearly rate regarding return, that is a massive conflict and only using more than financial obligation cost. If for example the interest is much like or even more than simply your expected mediocre yearly speed off go back, you to definitely favors financial obligation installment.

Individual disposition: Your emotions about this investing vs. personal debt cost choice matters, too. If you can’t sleep at night getting contemplating your own looming loans, simply work on using it down. In case the math cannot sway you firmly to just one front side and you will you are extremely enthusiastic about starting to invest, feel free to do that (but understand that taking a loss is a definite possibility).

Understand that backed finance was effortlessly at the good 0% interest, therefore paying those finance manage only be a top priority to own somebody who really dislikes its obligations.

Percentage measures

When you have decided to pay your figuratively speaking to some knowledge during graduate university, you have specific alternatives on how best to take action.

The foremost is one deferral decision that individuals thought during the birth. Even although you dont feel you have got to put payday express Tecumseh off since you can easily pay the minimal payment, deferring nevertheless may be beneficial for 2 grounds: 1) In the event that something previously emerged that avoided you from while making your own expected payment, your credit score would need a knock. 2) With no minimum fee necessary across the your fund, you can will lower one mortgage immediately.

Second, of course, if your financing are deferred, you are able to typical payments otherwise conserve for a time and also make large, lump-contribution repayments. It could be better to make less costs over the way off a-year, yet, if your financing is unsubsidized you might beat a small piece of currency to help you interest buildup. Talk with your own lender observe how happy they are to help you accept repayments off adjustable matter and also at unpredictable times. To own sponsored funds, you would not feel punished to have accumulating your payoff cash in your own coffers up through the entire deferment several months for as long because you reduced the sum of before the loans log off deferment.

3rd, inside your gang of college loans, you really have multiple other interest levels, possibly and one another sponsored and you may unsubsidized loans. When you have ount of cash to help you loan commission, you ought to put the whole percentage towards the latest unsubsidized loan that have the highest interest rate (your debt avalanche method).

Pay only the interest

While it’s a superb idea to spend some degree into the the money throughout deferment, I don’t find a persuasive good reason why you to matter is just equal the level of focus accruing. If you have the ability to build desire-just money, as to the reasons stop there? You really need to shell out around your finances allows.

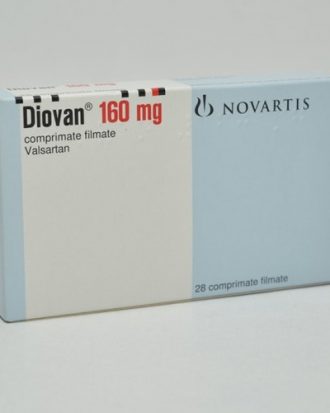

Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Alanil (Syp) 50ml

1 × ৳ 1.00

Alanil (Syp) 50ml

1 × ৳ 1.00  Closeup | 100 g

2 × ৳ 110.00

Closeup | 100 g

2 × ৳ 110.00  Luraprex (Tab) 20mg

1 × ৳ 20.00

Luraprex (Tab) 20mg

1 × ৳ 20.00  Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00  Maggi Masala Blast 252gm

1 × ৳ 70.00

Maggi Masala Blast 252gm

1 × ৳ 70.00  Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00