Believe providing a loan in place of delivering money from your colony egg

Many retired people believe they can not remove a loan-to have a car or truck, a home, otherwise a crisis-as they no longer receive a salary. Indeed, whilst it will be harder so you’re able to qualify in order to use inside old age, it is from impossible. Something essentially to cease, according to most experts, is credit from advancing years agreements-instance 401(k)s, individual advancing years accounts (IRAs), otherwise retirement benefits-given that doing so could possibly get adversely apply to both your deals as well as the earnings you confidence when you look at the retirement.

Trick Takeaways

- It’s essentially better to get some good sort of mortgage than just use from the old-age offers.

- Secured finance, and that want guarantee, are around for retirees and can include mortgage loans, family security and cash-away finance, contrary mortgage loans, and you will car and truck loans.

- Borrowers can usually consolidate federal student loan debt and you may mastercard debt.

- Just about anyone, in addition to retirees, can https://1hrtitleloans.com/title-loans-id/ also be be eligible for a secured otherwise an enthusiastic unsecured short-title financing, however these is risky and ought to qualify merely inside the a keen crisis.

Being qualified having Funds within the Advancing years

For notice-funded retirees that happen to be earning a majority of their money away from investment, rental property, and/otherwise advancing years savings, lenders normally influence month-to-month earnings using one out of two methods:

- Asset destruction–with this specific method the lending company subtracts any down payment regarding complete property value your financial possessions, after that takes 70% of one’s relax and you can splits they because of the 360 months.

- Drawdown towards property–this method matters normal month-to-month distributions from retirement membership while the income in the place of total possessions.

Remember that fund are generally secured or unsecured. A guaranteed mortgage requires the borrower to hold security, including a house, expenditures, vehicle, or other property, so that the mortgage. In the event the borrower does not shell out, the lender can grab the fresh security. A personal loan, which doesn’t need collateral, is more hard to see and has now a top interest than a protected financing.

Here are ten borrowing from the bank solutions-in addition to their advantages and disadvantages-one to retirees are able to use in lieu of bringing funds from their nest egg.

step one. Mortgage loan

The most popular sort of secure loan is an interest rate, and that spends the house you’re to purchase just like the security. The greatest problem with taking a mortgage to have retirees was income-particularly if much of it comes down out-of opportunities or offers.

2. Home Equity Loans and HELOCs

Household security funds and you will home guarantee lines of credit (HELOCs) are two version of secured loans that are according to credit against the collateral within the property. So you’re able to be eligible for her or him, a debtor must have no less than fifteen% in order to 20% security in their home-that loan-to-really worth (LTV) ratio out of 80% to 85%-and generally a credit score with a minimum of 620, although some loan providers place you to at the 700 to track down a great HELOC.

They are both safeguarded by homeowner’s family. A house collateral loan gives the debtor an upwards-front lump sum that’s paid back more a-flat period of your time with a predetermined interest rate and you will commission count. A good HELOC, concurrently, try a credit line that can be used as required. HELOCs normally have varying interest levels, and repayments basically are not repaired.

Significantly, the Income tax Cuts and you may Efforts Act no further allows the fresh deduction of interest on these several loans unless the money can be used having family renovations.

step 3. Cash-Away Home mortgage refinance loan

This alternative to a property guarantee mortgage pertains to refinancing a preexisting house for more than the borrower owes however, below this new home’s well worth; the excess amount gets a secured cash advance.

Until refinancing to own a shorter title-say, fifteen years-new debtor will stretch enough time it will require to pay off the mortgage. To determine ranging from an earnings-out re-finance and you can home security loan, consider rates into the dated and the latest financing once the well as settlement costs.

Trileptal (Tab) 300mg

1 × ৳ 20.06

Trileptal (Tab) 300mg

1 × ৳ 20.06  Ameloss (Tab) 5mg

1 × ৳ 100.00

Ameloss (Tab) 5mg

1 × ৳ 100.00  Alneed (Tab) 400mg

1 × ৳ 3.00

Alneed (Tab) 400mg

1 × ৳ 3.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00  Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00

Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00  Diapant (Diapar) MSis

2 × ৳ 140.00

Diapant (Diapar) MSis

2 × ৳ 140.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Win Boost (Pen)

2 × ৳ 10.00

Win Boost (Pen)

2 × ৳ 10.00  Amilin (Tab) 25mg

1 × ৳ 1.75

Amilin (Tab) 25mg

1 × ৳ 1.75  Exforge (Tab) 5/160mg

1 × ৳ 70.75

Exforge (Tab) 5/160mg

1 × ৳ 70.75  Avone Diaper (7-12kg/4-8kg) 5PCS

1 × ৳ 140.00

Avone Diaper (7-12kg/4-8kg) 5PCS

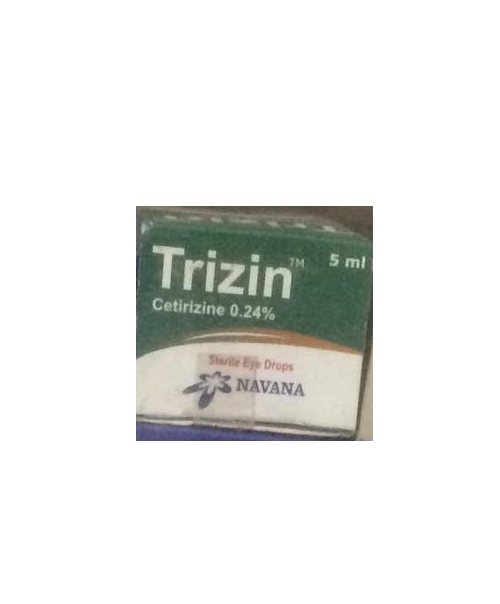

1 × ৳ 140.00  Trizin (Eye Drop) 5ml

1 × ৳ 140.00

Trizin (Eye Drop) 5ml

1 × ৳ 140.00