It expenses would provide federal student loan forgiveness in order to elementary and you will second educators exactly who illustrate science, technical, technologies, otherwise math

Sponsor: Sen. Murkowski [R-AK]Cosponsors: 2Introduced: NASFAA Realization & Analysis: Which bill would allow consumers to improve ranging from more cost arrangements centered on their state in place of very first are placed into good forbearance or basic installment bundle just like the transfer is created.

H.R.5126 – Fighting Predatory Lending inside Degree Act away from 2021

Sponsor: Associate. Van Duyne [R-TX]Cosponsors: 0Introduced: NASFAA Summary & Analysis: This costs manage now include Also fund designed to graduate people and you may mothers regarding the calculation to own a keen institution’s Cohort Standard Speed (CDR) in order for any standard on these funds is used in the brand new computation.

H.Roentgen.5084 – Education loan Refinancing Work

Sponsor: Associate. Turner [R-OH]Cosponsors: step one (1D; 0R)Introduced: NASFAA Realization & Analysis: That it costs will allow eligible federal individuals to re-finance their federal fund when rates of interest was quicker. Shortly after completing a credit card applicatoin to possess refinancing to possess an eligible government beginner financing, the fresh borrower can refinance their loan’s interest rate into interest title loans Spring Hill for current the fresh new consumers in one period of the app. The bill could guarantee that refinancing finance will not connect with a beneficial borrower’s payment per month confidence IDR repayment agreements and you can PSLF arrangements.

S.2596 – Mortgage Operate away from 2021

Sponsor: Sen. Rubio [R-FL]Cosponsors: 0Introduced: NASFAA Summary & Analysis: Which bill would remove notice and you can replace it having a-one-go out, non-compounding origination commission one to consumers pays along side lifetime of the mortgage. To possess individuals just who repay their finance reduced compared to the depending cost plan’s time frame, ED you are going to credit or refund consumers a calculated number of this new financial support commission. The bill could succeed merely one or two payment plan possibilities, the high quality 10-year fees package, and an income driven fees bundle, to-be made up of which expenses. Individuals create instantly be put on the IDR plan, but may choose to go on to the quality installment plan.

H.R.4797 – Student loan Relief Act

Sponsor: Representative. Carter [D-LA]Cosponsors: 0Introduced: NASFAA Conclusion & Analysis: So it bill would want the latest Department off Training to help you forgive $fifty,100000, or even the aggregate from good borrower’s equilibrium, almost any are less, away from government student loan obligations for everyone consumers. In the event the borrower keeps over $fifty,000 into the education loan personal debt, new Agencies was trained so you’re able to forgive the newest loans toward highest interest levels very first. People amount forgiven is omitted out of taxable earnings. Members of Congress could be ineligible for this system.

H.R.4727 – Stalk K to help you Field Work

Sponsor: Representative. Swalwell [D-CA]Cosponsors: step one (1D; 0R)Introduced: NASFAA Summation & Analysis: Which costs tries to open pathways so you’re able to Stalk work for college students and you may advantages. It would plus forever increase this new $250 income tax credit for teachers whom buy college or university provides due to their classrooms and you may contributes an additional $250 to have Stem supplies. Concurrently, it might promote certain businesses an income tax borrowing from the bank to hire reduced Stalk interns and you can apprentices. Finally, it could need advanced schooling organizations participating in the latest government really works data system to allocate no less than seven percent of them funds to spend youngsters in Stalk jobs.

H.R.4725 – Zero Education loan Desire Act

Sponsor: Representative. Swalwell [D-CA]Cosponsors: dos (2D; 0R)Introduced: NASFAA Bottom line & Analysis: Which costs seeks so you can notably slow down the burden of interest charge towards the student loan borrowers. Which statement do lose and you will forgive the desire billed to your this new and you may present federal figuratively speaking minimizing the interest rate so you’re able to no, energetic .

H.R.4724/S.2478 – Strengthening Mortgage Forgiveness having Personal Servants Work

Sponsor: Agent. Swalwell [D-CA]Cosponsors: 9 (9D; 0R)Sponsor: Sen. Blumenthal [D-CT]Cosponsors: cuatro (4D; 0R)Introduced: NASFAA Realization & Analysis: Which bill tries to enhance the amount of student loan forgiveness to possess public-service professionals, also educators, plan officials, and you can personal fitness gurus. Which bill perform foot the level of mortgage forgiveness of these positions considering their years of public service.

Boost 3X More Stamina Jar | 400 g

2 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

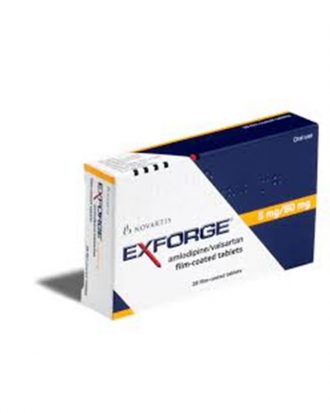

2 × ৳ 390.00  Exforge (Tab) 5/80mg

1 × ৳ 50.50

Exforge (Tab) 5/80mg

1 × ৳ 50.50  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Adelax (Tab)

1 × ৳ 5.02

Adelax (Tab)

1 × ৳ 5.02  Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00  Crunchos Almond Roasted & Salted 100gm

1 × ৳ 440.00

Crunchos Almond Roasted & Salted 100gm

1 × ৳ 440.00  Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

1 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

1 × ৳ 50.00  Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00