Subtotal: ৳ 308.00

Bringing a consumer loan could make experience if you’d like currency to fund surprise debts, home improvement and you will solutions, otherwise debt consolidation reduction. Centered on Experian, Americans got aside step 3.1 million the new personal loans from inside the 2020, with many credit due to pandemic-associated adversity. But what do you do to own an unsecured loan after you you want one?

You might is actually a consumer loan mobile application if you’re looking having easier capital which have potentially straight down costs than you can shell out during the a lender. You’ll find a growing number of loan providers that provide unsecured loans online.

Trying out financing mobile application was a different sort of experience. However it is simpler to browse than you may thought.

What’s a personal bank loan Application?

A consumer loan mobile app is actually a software that allows your to apply for and you may manage unsecured loans from your own mobile device. You will find various ways to get an internet unsecured loan, starting with your existing bank’s mobile application. You’re capable apply for an unsecured loan as a consequence of the software, based on exacltly what the financial has the benefit of. And once recognized, you might look at the harmony otherwise agenda bill money from exact same software.

There are also software that are customized for only personal loans. These are with the lenders and you will credit markets one to specialize in offering funds on line. This new site is the same, in the event. You could:

- Download a loan mobile app

- Opinion consumer loan choices

- Apply for a personal bank loan

- Look at the harmony and come up with repayments after you may be accepted

Unsecured loan mobile programs build credit money smoother. Assuming you have sense using mobile banking programs or private finance applications, you’ll find they’re not one different regarding navigating her or him.

The kinds of fund you can get due to a smart device limit may differ, centered on hence software you will be playing with. But generally, you will be in a position to submit an application for the pursuing the through an application:

- Signature loans. A personal loan is currency you obtain to pay for individual expenses. Anytime your car stops working, eg, or the animal requires crisis businesses you might make an application for a good consumer loan because of a cellular app to pay for those people expenses.

- Auto loans. If you’re in the industry to purchase an automobile, you could try a car loan mobile application to discover the correct borrowing from the bank choice. These programs shall be given by financial institutions, borrowing from the bank unions and low-lender car loan providers.

- Repayment fund. An installment mortgage are a loan that’s repaid in a lay level of installment payments, always possibly month-to-month or biweekly. This type of programs might require zero credit score assessment having approval while can put on to them using a mobile application.

- Wage advance loans. Wage advance applications lend your money up against your following salary. You could potentially think one of these mobile loan apps for those who need use a lesser amount of currency as possible pay-off apparently quickly.

- Home business money. For people who run a small business and require dollars to fund expenditures, then there’s an app for this, as well. Home business mortgage apps can help you find the appropriate loan solution considering your organization types of, profits and credit score.

These days, there are even programs that allow you to apply for a good mortgage from the mobile device. The main point is that in case you need to use for nearly any excuse, there’s a www.carolinapaydayloans.org/ software which will help.

Is it Safe to apply for that loan Using my Smartphone?

Finance companies and you will loan providers try taking protection and study privacy far more undoubtedly than ever before nowadays, as a result of an enthusiastic uptick inside the cybercrime. At the same time, it recognize the need for simpler use of borrowing solutions, hence the rise of mobile mortgage application.

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

Closeup Ever Fresh Anti Germ Toothpaste | 45 g  American Hervest Milk (290ml)

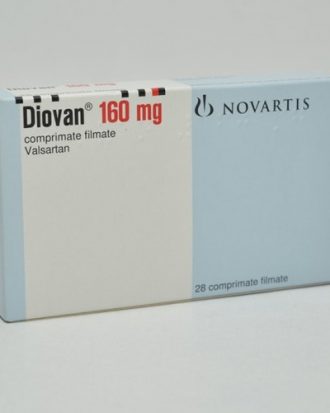

American Hervest Milk (290ml)  Diovan (Tab) 160mg

Diovan (Tab) 160mg