Subtotal: ৳ 397.00

Forty-four billion People in america features been able to accumulate $1.75 trillion in the figuratively speaking, accounting towards the next premier source of obligations from the All of us shortly after mortgages. And just such as the financial crisis that preceded they, the fresh education loan ripple isn’t something away from free business capitalism but rather ages of bodies wedding having composed a keen business protected to virtually any actual industry challenges, in which cost rise from year to year, and money was given out freely to people who’ll never have the ability to repay him or her. Individuals who responsibly reduced the method as a result of school or retired on their own to lower-purchasing career possibilities in the place of a diploma have an obvious provider getting anyone who has racked up academic financial obligation: “By using out financing, pay it back!”

Unfortuitously, the solution to the latest student loan crisis may possibly not be you to definitely effortless. Of the $1.75 trillion inside the scholar debt, taxpayers happen to be yourself guilty of about $1.dos trillion off authorities-issued loans when the borrowers standard. The majority of the remaining countless billions of bucks away from college student financing personal debt has been thought of the private financial world where that it financial obligation might have been packaged toward monetary instruments entitled Pieces, otherwise student loan house backed bonds. Whether or not it name ring a bell, you are planning on home loan backed bonds. It is unlikely which you yourself can ever before skip if the correct characteristics out-of AAA-ranked home loan-recognized securities is actually found about ten years ago. The good Market meltdown erican taxpayers have been compelled to bail-out the fresh new banking institutions into song from $633.6 million, $661 mil from which went along to Coloradan banking companies by yourself. The TARP bailouts crazy People in the us and you will really resulted in brand new manufacturing of the Tea-party way.

Uncorrected, student loan loans could keep young adults from to buy property and trucks and achieving families or actually retiring that is on condition that they’re able to survive this new intellectual pain from never being capable stay away from that it financial obligation

Since finance companies can be repossess domiciles within the standard on their mortgages, it’s difficult adjust the doorway tresses into another person’s degree. Anybody such as Joe Biden had a means to fix remove it economic chance on banks, and you will Joe worked relentlessly out of 1978 to 2005 round the several Democrat and you will Republican administrations in order that it will be extremely hard for anyone to flee education loan personal debt using personal bankruptcy. Joe Biden enabled student loan loans in order to haunt men endlessly during their existence, garnishing wages and even future to possess handicap and you will Personal Shelter gurus. People Public Safeguards pros was a big deal to people now old 60 or elderly who owe $86 million inside the figuratively speaking. Actually there is certainly an effective 71.5% boost within the last five years into the seniors old 60-69 who have started student loans, the biggest percentage escalation in all ages class of these obligations. This is simply not only a great millennial or Gen-Z situation.

Goldman Sachs enjoys whatever they label the new Slabs “bubble” claiming regardless if “missed payments dwarf brand new financing marketplace for houses,” it is “one to segment of the industry which is emerging because a nice-looking financial support.” At the very least Goldman finds out education loan financial obligation glamorous, since merely-create 2019:Q4 statement regarding the Provided cards, “Rising delinquencies certainly consumers within their 20s and you may 30s could be about higher levels of student loan obligations, which can make it difficult having customers to cover the their bills.” All this songs therefore familiar.

Throughout the an effective knowledge at the Light Domestic, President Trump derided the fresh new seedy workings of degree program and the over $35,one hundred thousand children are now stuck with typically, mentioning one to center-class American family members get tricked when you’re taxation-exempt colleges having immense endowments make a fortune. He directed brand new Agency of your own Treasury and you can Agency off Training to spell out tomorrow earnings and you will loan cost cost having the biggest at each college or university. Even more important, President Trump purchased the fresh new DOE to bring about a strategy that needs universities and colleges to “has facial skin regarding game because of the revealing an element of the economic likelihood of the fresh student loan personal debt.”

These are seriously some of the well-known-feel rules you to definitely Republicans can be with certainty help, however the time for you assistance these types of proposals was years back, perhaps even in 2015 when Republican Senator Lamar Alexander regarding Tennessee, once the President of your own Senate Panel on Health, Studies, Work, and Pensions, defined these types of extremely reforms in his “Risk-Sharing/Skin-in-the-Games Principles and Proposals” report.

Should you want to understand the price of to purchase votes in 2020, look to a study away from LendEDU in which 62% out-of respondents having student education loans would give upwards its ballots to remove their student loan debt. ”

Whilst we enter an election seasons in which Popular top-athlete Bernie Sanders with pride proposes canceling every education loan obligations, may possibly not become recommended for Chairman Trump so you’re able to release a funds proposition you to definitely leads to headlines you to cry aside, “Trump seems so you can destroy education loan forgiveness program

The brand new Texas Sunrays points to a review of bodies data you to suggests good $twenty six million education loan weight common because of the 734,100 Coloradans, and you may 20,000 rural Coloradans was troubled more to make people money anyway. All of our Republican You.S. Senator Cory Gardner reveals allowing companies to “make up in order to $10,000 annually inside tax-free contributions on the workers’ beginner obligations payment.” Without a doubt, of numerous create believe billion and you may trillion buck businesses having record payouts which manage to account its way into the no and you can bad income tax debts from year to year ought to provide degree for free so you can produce the team they want in lieu of acquiring a lot more income tax holiday breaks otherwise allowing them to import a lot more H-1B charge holders and their H-4 partners that compete with Western school graduates getting services. In the house, all of our You.S. User Ken Money, in addition to settee of your Tx Republican Party, in a single breath p you to votes to benefit big providers, however transforms doing and you will guides most Home Republicans and Democrats so you’re able to vote so you’re able crucial link to agree Hours. 1044, “an eco-friendly cards giveaway to have 3 hundred,100000 Indian experts that allows India so you can effectively monopolize the new You.S. environmentally friendly card program for around next 10 years.” This new You.S Chamber away from Business, Koch brothers, and lobbyists to possess big company like IBM and you can Hp, tech people including Microsoft, Craigs list, and Twitter, and Indian outsourced firms including Cognizant was in fact all of the happy which have Agent. Buck’s performance to the high hindrance from Western experts. When you look at the a definite defiance from Trump’s “America Very first” coverage, it appears as though new swamp keeps claimed a differnt one.

Having 70% off millennials extremely probably vote to possess a good socialist candidate in the event the it releases them on the personal debt enforced on them by the a good corrupt system, Republicans who want to discover capitalism succeed ought to provide quantifiable relief in a fashion that agrees with traditional thinking. Ahead of other TARP-design financial bailout to own figuratively speaking was pressed up on all of us once more without consent, we need to change the fresh student loan system in a fashion that assurances the latest stability off years out-of Us citizens ahead.

Diapant (Diapar) MSis

Diapant (Diapar) MSis  Maggi Masala Blast 252gm

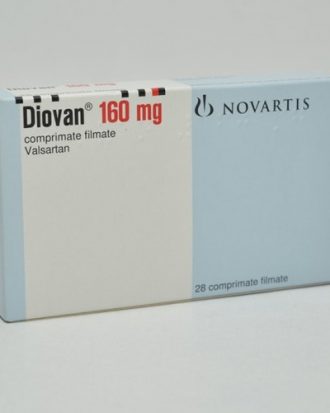

Maggi Masala Blast 252gm  Diovan (Tab) 160mg

Diovan (Tab) 160mg