Discover a vibrant age group of new applications, linked with prepaid service debit notes, to simply help minors purchase and you will carry out their cash

Cash was once the only method for the kids to pay its allowance – who did not have a jar laden up with coins? The good news is, cards was queen while the days of holding mom’s mastercard and additionally a note saying it absolutely was okay to use try much time about us.

They make simple to use to have moms and dads to transmit extra financing and you can pick in which they go, while also knowledge children valuable lessons regarding the cost management, how many payday loans can you get in South Carolina? protecting and you can using.

GoHenry application

GoHenry is one of the smooth broadening apps (and additionally a good debit credit) to help infants realize about, manage and you can purchase their cash.

That have a connected pre-repaid debit cards and you can software, infants can find out the basics off budgeting and you will paying versus racking upwards huge debts. GoHenry is known for their fun “money objectives” making it basic interesting for your children to learn currency basics. Together with, with lots of possess getting mothers such as for instance an allowance director, real-time notifications, and you will personalized investing regulation, there is certainly assurance for the whole loved ones.

More step one.5 mil families have fun with GoHenry to assist their babies carry out and purchase their funds! You can attempt away GoHenry with a thirty-date trial. Good for infants old six to help you 18, incorporating clips and you will entertaining exams from the GoHenry app, in addition to an actual debit credit to have requests, nurtures money depend on and creates actual-community economic patterns .

Famzoo Credit card®

Famzoo also provides prepaid service debit cards for children of all ages, even those young than just 13 years of age. The newest notes given at under 13s was “with respect to” notes where in fact the mother is the court card holder. This new parent can also be song get hobby and should show up with the kid in store if the card is put.

The new debit credit really works within the conily checking account, where in actuality the mother or father can import money from its “first resource credit” onto the children’s prepaid debit credit. Toward cards are a mastercard, it’s acknowledged almost everywhere online. Find out about the costs for it cards below:

- Membership payment – there was a fee to utilize Famzoo, to the cheapest price are $dos.fifty for each family per month having 2 yrs (but you’ll have to pay the cost in advance, and this can cost you $). If you would like new subscription in order to vehicles-replace each month, it’s $5.99 30 days.

- Other fees – there aren’t any overdraft costs, zero inactivity charge, no borrowing from the bank fees to bother with. There are not any buy charges so long as brand new credit try found in the fresh U.S. just. A delivery commission (having shipping away several cards) may apply.

- Loading will cost you – loading new credit which have loans is free of charge so long as you generate a primary deposit from your own savings account. There are many steps you can use to own reloading, but fees could possibly get apply.

Greenlight

Greenlight also provides a great debit cards for children of any age. Mothers must implement for their children. Utilising the Greenlight software, children can demand finance and moms and dads normally agree or reject the consult. After a consult could have been “greenlighted”, the cash is put into the fresh child’s debit credit, to enable them to buy something. The investing are monitored. Note these key points:

- Subscription fee – the cost to utilize Greenlight are $4.99 monthly each friends membership.

- Packing will set you back – it’s absolve to weight money onto the Greenlight Credit, however you need to transfer at least $20 each time if you load thru debit card. For those who transfer fund from the direct deposit, the minimum number expected is actually $step 1.

Clear Complete Active Care | 180 ml

5 × ৳ 220.00

Clear Complete Active Care | 180 ml

5 × ৳ 220.00  Clear Men Anti-Dandruff | 330 ml

4 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

4 × ৳ 450.00  Closeup | 100 g

4 × ৳ 110.00

Closeup | 100 g

4 × ৳ 110.00  Carex Classic Condoms | 3 pieces

3 × ৳ 35.00

Carex Classic Condoms | 3 pieces

3 × ৳ 35.00  Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

2 × ৳ 240.00  Crunchos Pistachio Roasted & Salted 200gm

1 × ৳ 710.00

Crunchos Pistachio Roasted & Salted 200gm

1 × ৳ 710.00  Boost 3X More Stamina Jar | 400 g

3 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

3 × ৳ 390.00  Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00  American Hervest Milk (290ml)

1 × ৳ 200.00

American Hervest Milk (290ml)

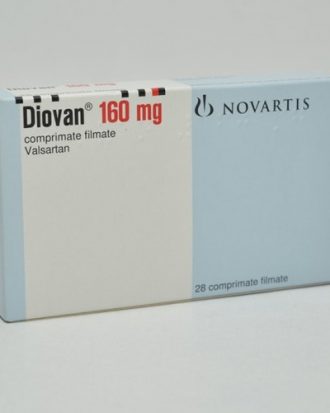

1 × ৳ 200.00  Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00