Make sure to confirm along with your mortgage expert in advance of visiting your own regional part

You are planning to leave the newest OneMain Monetary webpages. By pressing “Unlock Website inside New Windows,” you will get into a 3rd party’s webpages, that’s regulated by a separate Terms of service and Privacy Coverage. Delight comment so it 3rd party’s Terms of service and you can Privacy policy up on typing the website.

Checking out a branch

Face treatments is actually elective for users and you may associates except if if you don’t communicated according to local criteria. Excite follow inside-branch cues out of people safety measures to guard new well-becoming of your people, team members and you may society.

Favor OneMain Monetary

Approximately step one,eight hundred branches inside the 44 claims, OneMain’s only focus is to try to help you get the private loan you desire, when you need it. Right from household, and you may rather than impacting your credit score, you can find out while prequalified to have a guaranteed or unsecured loan. Just after you are prequalified, we are going to begin the mortgage techniques along with you. Take note one a challenging credit remove arise when you submit your loan software once prequalification. From there you might contact us at Hobbs department to talk to a loan expert throughout the almost every other issues you really have.

Contact us now at the 575-392-3538 in order to schedule an appointment having one of the loan experts. With once-circumstances appointments available, you could potentially pick an occasion that works for you.

Has actually issues? Discover the responses you would like when you go to our very own FAQ web page, or perhaps give us an email and you may we’d be happy to let.

1 Only a few applicants will be eligible for huge loan number or most positive loan terms. Big mortgage numbers need a first lien to your a motor vehicle no more than 10 years old, that suits our very own worthy of standards, entitled on your name which have good insurance. Financing recognition and you will actual mortgage terminology depend on what you can do to help you satisfy the borrowing standards (including a responsible credit history, adequate income just after month-to-month costs, and you will supply of security). APR’s are high to the loans maybe not covered because of the a motor vehicle. Energetic responsibility military car title loan TX, their lover otherwise dependents included in this new Armed forces Credit Operate will get not vow one car while the security.

Consumers in these claims is actually subject to these types of minimal loan brands: Alabama: $2,a hundred. California: $3,100000. Georgia: Unless you’re a gift buyers, $step three,100 minimal loan amount. Northern Dakota: $dos,100. Ohio: $2,one hundred thousand. Virginia: $2,600.

Consumers (except that introduce people) on these claims are subject to these limitation unsecured loan brands: Vermont: $7,five-hundred. An unsecured loan was a loan hence doesn’t need you to include collateral (like a car) on lender.

dos Crucial Notice Regarding Refinancing or Debt consolidation: Refinancing or consolidating your obligations can lead to large complete finance charges should your interest is higher or even the financing name is longer. It’s also advisable to meticulously think about the impact out of increasing your loans, monthly premiums, and you can period of your own repayment name. OneMain funds become origination charge, and this ount away from more income that you receive or that’s available to repay current expense. See omf/legal/loan-costs for much more information.

3 Funding Choices; Availability of Finance: Loan proceeds are disbursed of the take a look at otherwise digitally transferred in order to the latest borrower’s savings account from the Automatic Cleaning Household (ACH) otherwise debit credit (SpeedFunds) systems. ACH fund come everything one or two business days immediately after the borrowed funds closure big date. Money using SpeedFunds might be utilized towards mortgage closing big date by using a bank-given debit cards.

cuatro OneMain mortgage continues can’t be used for postsecondary academic expenditures because the outlined because of the CFPB’s Control Z such university, college or university, or vocational expenses; your providers or commercial mission; to purchase securities; or playing otherwise unlawful products.

OneMain Financial Group, LLC (NMLS# 1339418) – CA: Loans made or arranged pursuant to Department of Financial Protection and Innovation California Finance Lenders License. PA: Licensed by the Pennsylvania Department of Banking and Securities. VA: Licensed by the Virginia State Corporation Commission – License Number CFI-156. OneMain Mortgage Services, Inc. (NMLS# 931153) – NY: Registered New York Mortgage Loan Servicer. Additional licensing information available on OneMain Disclosures.

For residents of the State of Washington only: OneMain Financial Group, LLC – Consumer Loan Company License – NMLS # 1339418. Follow this link for the NMLS Consumer Access Database.

For Property Advisors regarding County of Washington, please email united states at the following the hook up in regards to your own users loan mod status: Please make sure that your customer has provided united states having agreement to operate along with you.

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00  Abecab (Tab) 5/40mg

1 × ৳ 18.00

Abecab (Tab) 5/40mg

1 × ৳ 18.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

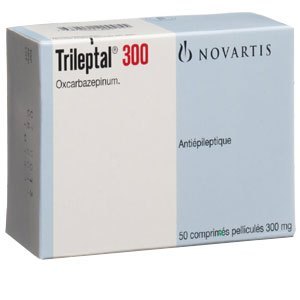

1 × ৳ 240.00  Trileptal (Tab) 300mg

1 × ৳ 20.06

Trileptal (Tab) 300mg

1 × ৳ 20.06  Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00  Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00  Acme Premium (Juice) 250ml

1 × ৳ 25.00

Acme Premium (Juice) 250ml

1 × ৳ 25.00