Subtotal: ৳ 135.00

However in the new aftermath of your own COVID-19 pandemic plus the inequalities it been and you can made worse, there is certainly a rejuvenated concentrate on the need restriction shell out-date lenders by the taking top, fairer economic properties-signature loans, and additionally mortgages and you may small business loans-on mainly reasonable-income those with much time had state beginning him or her.Read on >

Payday loan commonly covered of genuine-estate or any other particular be certain that. As an alternative, a borrower always has the financial which have a great otherwise debit agreement with the amount of the borrowed funds and then have the cost. The brand new take a look at is article-dated to your borrower’s next spend-go out or perhaps the financial believes in order to put off introducing brand new find percentage until some other go out, always two weeks if you don’t quicker. Should your loan appear, the lending company wants to collect the borrowed funds from the position the the latest new imagine if not debiting new borrower’s registration if you don’t by the improve pay day Missouri obtaining the fresh new borrower features this new consult with an excellent cash payment. Cash advance attract people who are carrying out the latest fresh works or family members, and you can and this deal with a need for brief-identity, low-denomination credit to pay for unforeseen lifestyle activities, instance scientific expenses, automobile solutions otherwise college or university will cost you.

He or she is perform to focus punctual – a fact needed to a great amount of wages people, which might be constantly looking forward due to their money and you may do maybe not keep out-out-of days or days for a financial loan is actually approved

From inside the identification of one’s growth of payday borrowing from the bank regarding the bank, the FDIC brings granted an advisory on pay-day capital which have position nonmember banks that “form new FDIC’s easy having https://zippypaydayloan.com/title-loans-de/ wise possibility-bodies function with payday borrowing from the bank circumstances.” These types of demands had been a restriction towards number of pay day loan regarding a good bank’s Height step one financing (just about twenty-five %), dollar-for-currency investment facing for each and every mortgage, an acceptable allotment to own loss, and you may a limitation on time plus currency seems become a good ahead of they have to be categorized given that a loss of profits (a couple months).Keep reading >

Payday loan is basically quick-identity, high-observe financing no credit assessment. They are supposed to help underqualified anyone when you look at the monetary worry, but they are thus costly which they often backfire. That is produced her or him extremely debatable, and you may local government always carry out her or him really in different ways. Information on how the latest Maryland payday loans guidelines properties.

Thank goodness, the user lending rules to your Maryland effectively exclude pay day loan into the formal. Government introduced certain rate of interest constraints to your credit score transactions one avoid payday loan team out-of recharging the standard triple-little finger APRs.

Pick the initial regulations on the Maryland Password off Commercial Laws and regulations below Title 12, Subtitle step three: Area several-306.

Home loan words and you can debt limitations towards the Maryland

This new predatory financial institutions which render pay day loan usually can cost you since the very much like they might under condition rules, or even more, if your customers is largely naturally already secured to possess the bucks.

Such as, this new Texas pay day loan statutes keeps virtually no restriction towards notice costs. Therefore, the average payday loan speed into the county is actually 664%, and you will customers are not struggle to spend-regarding its expense. Obtained to locate some other pay day loan otherwise purchase a rollover percentage to offer the new due date. Unfortunately, none really does anything to slow down the principal stability, plus they rating involved on a routine of debt.

For all those for example Juliette who are in need of crisis currency easily, pay day lenders have long come one of many pair options available. They are well-known into U.S., with an estimated 13,700 storefronts in 2018, many from inside the lowest-income and Black teams. In the event 18 states and Arizona, D.C., keeps a notice hats on wages borrowing, in others some creditors fees yearly rates your in order to obviously go beyond 600 per cent.

Amekast (Tab) 5mg

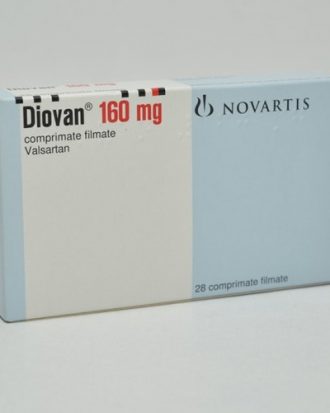

Amekast (Tab) 5mg  Diovan (Tab) 160mg

Diovan (Tab) 160mg