Even more contingent dollars believe of up to $0

“We are thrilled to expand the franchise towards upstate South Carolina field and mate that have eg a good area lender,” said Dana Stonestreet, President and you can Chief Working Officer out of HomeTrust. “With the help of our good funding base and you will historical triumph inside the commitment progress, we’re better-organized to help you forge a lot more society lender proper partnerships along the Carolinas.”

Russel Williams, President and you may President off BankGreenville, stated, “Which merger are a combination of several organizations with comparable concepts, societies and you can key thinking. We look forward to providing just like the Greenville Field Chairman to own HomeTrust and continuing to serve our very own members with more products and services. The current support service and you will credit staff will continue to be in position, and in addition we expect you’ll create new people even as we join the HomeTrust team while increasing the field exposure. That have solid resource support, our company is happy to get the resources to grow and build with the ability to build big financing and stay a critical contributor toward monetary growth in Greenville County.”

Created in 2006, BankGreenville has over $110 million within the possessions and you may works a full provider financial studio from its head office in Greenville, South carolina. The fresh new BankGreenville area can be found in the 499 Woodruff Street, near brand new quickly development Verdae people, a-1,a hundred acre grasp structured enterprise having domestic, industrial, medical work environment, and you may shopping parts.

“There has never been a very compelling time for neighborhood finance companies to become listed on forces to get to durability for the future from home town financial. Our long-term eyes is to try to realize proper combos with other area finance companies, conducted which have discipline and you will rigor to make well worth for the customers, teams, the brand new communities we serve and you can all of our shareholders,” said F. Ed Broadwell, Ceo and Chairman from HomeTrust.

The fresh merger agreement might have been unanimously approved by the forums off administrators regarding one another enterprises. The order is expected to close throughout the 3rd quarter out-of 2013, at the mercy of traditional closure requirements, plus regulatory approvals and BankGreenville stockholder approval.

Underneath the terms of the latest contract, BankGreenville investors are certain to get $six.sixty for every single share inside bucks planning. That it signifies as much as $seven.8 billion off aggregate bargain idea. 78 for each share (or whenever $0.9 mil) may be know within conclusion off 24 months pursuing the closure of this deal. 0 billion.

HomeTrust anticipates so it purchase could be accretive so you can income (ahead of merger will set you back) in the first seasons away from shared surgery and accretive to concrete publication worth in about dos.5 years.

HomeTrust Bancshares, Inc. is actually advised from the exchange by the Keefe, Bruyette and you may Woods since the monetary advisor and you may Silver, Freedman & Taff, LLP as legal counsel. BankGreenville is informed by Banks Roadway Lovers, LLC as the financial advisor and you can Nelson Mullins Riley & Scarborough LLP since the legal advice.

Toward e the latest carrying business to have HomeTrust Financial (the latest “Bank”) in connection with the culmination of one’s Bank’s conversion process on the common towards the inventory form of company and you may HomeTrust’s relevant public stock giving. Regarding offering, HomeTrust ended up selling 21,160,100 offers out-of popular stock at a cost off $, having gross providing continues of $211.6 mil. HomeTrust’s preferred stock began change to your Nasdaq Around the globe , under the icon “HTBI”. HomeTrust Lender, together with the financial departments – HomeTrust Lender, Tryon Government Bank, Shelby Deals Financial, House Discounts Financial, Commercial Government Lender, Cherryville Government Financial and you can Rutherford Condition Financial, try a residential district-oriented standard bank having $1.sixty billion when you look at the assets and complete real funding of $372.1 million or 23.3% out-of complete assets at the time of . The lending company is the 12th largest financial based during the New york.

BankGreenville Economic Company was a-south Carolina firm and that operates while the the https://pdqtitleloans.com/installment-loans-pa/ holding team getting BankGreenville, a state chartered banking business based inside Greenville, Sc. Because the the beginning inside 2005, BankGreenville has furnished banking services and products along with commercial, individual and mortgage loans to individuals, small- so you’re able to typical-size of businesses, and you may masters about Greenville State area. On , BankGreenville got consolidated possessions of $111.dos million, dumps regarding $92.9 mil and stockholders’ collateral away from $ten.5 million.

The financial institution offers conventional economic features within the local groups as a result of their 20 full solution workplaces for the Western Vermont, such as the Asheville urban city, and “Piedmont” region of Vermont

Which news release can get have particular give-looking comments. Forward-appearing statements become statements of envisioned upcoming events and can getting acknowledged by the reality that they don’t connect purely to historical otherwise newest activities. They often times include terms eg “faith,” “anticipate,” “greet,” “imagine,” and you will “intend” otherwise coming otherwise conditional verbs such “usually,” “would,” “is always to,” “you will,” or “can get. Specific circumstances that will produce actual brings about differ materially off expected results for the firms away from HomeTrust Bancshares, Inc. The pass-looking statements that individuals build contained in this discharge rely upon management’s viewpoints and you will assumptions during the time he or she is made and you may may turn off to become wrong because of inaccurate presumptions i can make, by the facts portrayed significantly more than otherwise because of additional factors that people don’t foresee.

New contingent consideration is based on the efficiency of a select pond regarding fund totaling just as much as $8

We really do not deal with and particularly disclaim one obligations so you can improve any forward-appearing statements so you’re able to mirror the latest thickness off envisioned otherwise unexpected situations or affairs following go out of such comments. These types of dangers can cause all of our real results for financial 2013 and you may beyond in order to differ materially off people shown in just about any pass-searching comments from the, or for, you, that can adversely affect our working and inventory rate overall performance.

HomeTrust Bancshares, Inc. Dana L. Stonestreet – President and Captain Operating Officer Tony J. VunCannon – Older Vice-president and you will Captain Financial Administrator 828-259-3939

BankGreenville Financial Enterprise Russel T. Williams – Chairman and President Paula S. Queen – Exec Vice president and you will Head Monetary Administrator 864-335-2200

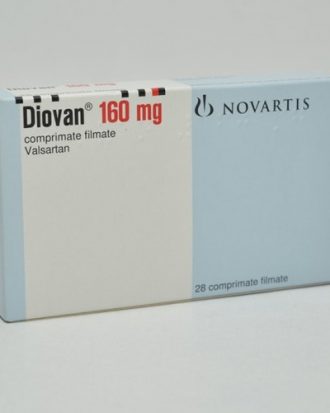

Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Himalaya Moisturizing Aloevera (Face Wash) 100ml

1 × ৳ 190.00

Himalaya Moisturizing Aloevera (Face Wash) 100ml

1 × ৳ 190.00  Exforge (Tab) 5/160mg

1 × ৳ 70.75

Exforge (Tab) 5/160mg

1 × ৳ 70.75  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

5 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

5 × ৳ 50.00  Strepsils Honey & Lemon

1 × ৳ 13.00

Strepsils Honey & Lemon

1 × ৳ 13.00  Closeup | 100 g

2 × ৳ 110.00

Closeup | 100 g

2 × ৳ 110.00  Aldorin (Tab) 50mg

1 × ৳ 10.00

Aldorin (Tab) 50mg

1 × ৳ 10.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Carex Classic Condoms | 3 pieces

1 × ৳ 35.00

Carex Classic Condoms | 3 pieces

1 × ৳ 35.00  Durex Play Gel 100ml

1 × ৳ 700.00

Durex Play Gel 100ml

1 × ৳ 700.00  Crunchos Almond Roasted & Salted 100gm

1 × ৳ 440.00

Crunchos Almond Roasted & Salted 100gm

1 × ৳ 440.00  Allah Shafi Honey (80gm)

1 × ৳ 135.00

Allah Shafi Honey (80gm)

1 × ৳ 135.00  Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

3 × ৳ 140.00  Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00

Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00  Maggi Masala Blast 504gm

1 × ৳ 140.00

Maggi Masala Blast 504gm

1 × ৳ 140.00  Glycephage (Tab) 500mg

1 × ৳ 5.00

Glycephage (Tab) 500mg

1 × ৳ 5.00  Nasal Inhaler Mark 2

1 × ৳ 100.00

Nasal Inhaler Mark 2

1 × ৳ 100.00  Himalaya Purifying Neem (Face Wash) 150 ml

1 × ৳ 225.00

Himalaya Purifying Neem (Face Wash) 150 ml

1 × ৳ 225.00  Adelax (Tab)

1 × ৳ 5.02

Adelax (Tab)

1 × ৳ 5.02  Mederma Advanced Plus (Scar Gel) 10gm

1 × ৳ 920.00

Mederma Advanced Plus (Scar Gel) 10gm

1 × ৳ 920.00  Kalogira (Amar Food) 200gm

1 × ৳ 105.00

Kalogira (Amar Food) 200gm

1 × ৳ 105.00  Trileptal (Tab) 300mg

1 × ৳ 20.06

Trileptal (Tab) 300mg

1 × ৳ 20.06  Abecab (Tab) 5/40mg

1 × ৳ 18.00

Abecab (Tab) 5/40mg

1 × ৳ 18.00