What are the Drawbacks out-of Tribal Financing?

The many benefits of tribal finance act like that from conventional pay day loan: customers can access dollars rapidly, in the event they don’t have good credit history or proof out of stable income. Both sorts of money render almost instant money that are easy to get recognized to possess and can assist individuals safeguards unanticipated will cost you otherwise link openings ranging from paychecks.

Together with giving quick use of cash, tribal loans can be beneficial for individuals with good reasonable credit score and no money to use given that guarantee. In many cases, nevertheless they enable men and women to obtain more they would end up being able to out-of a conventional lender, and there is actually less inspections positioned, too.

Tribal financing promote some other terms to conventional payday loans, and are usually commonly thought a harmful option for consumers, specifically those just who may not be able to spend the money for loan right back. The biggest cons to take on become:

- Very high tribal interest rates.

- Partners checks.

- Potential to address insecure, eager those who you prefer money quick.

- Shortage of transparency in terms of rates, payments, and you can money solutions.

- Diminished county control minimizes individual shelter rather.

- Chance of losing about which have repayments.

- Dishonest strategies associated with loan providers who’ve zero legitimate or profound connection to Indigenous American tribes or countries.

Pointers having Tribal Lending

While contemplating taking right out a loan and are investigating selection, as well as tribal lending, you will need to think about the pros and you may disadvantages and you will make sure that you comprehend the terms of the loan agreement.

When taking away an instant payday loan away from a medication lender, you may be covered by condition rules and tips designed to cure threats for users.

That have tribal financing, there clearly was little shelter offered, and also the terms of the borrowed funds arrangement you may alter, causing you to be out of pocket and you will against the fresh new impossible activity out of paying the money back.

It is wise to discuss choice before you apply for a financial loan away from an excellent tribal financial. Most of the time, it is best to stop taking out tribal loans.

Choice so you can Tribal Financing

So, imagine if you decide to stop tribal finance based on all of our pointers above. Exactly what more is it possible you manage when you require the cash quick? Listed below are some choices:

Signature loans are provided by lenders, and additionally finance companies. For people who make an application for a personal loan, you obtain a sum of money and repay it when you look at the installments more than a decided term. Generally speaking, personal loans provide low interest and much time-identity credit options.

A credit check is done to evaluate suitability and you may customers can also be use large sums of money. Personal loans are available to consumers having a good credit score ratings and a stable money. If you have a poor credit score, if any steady earnings, you may find it difficult to get accepted for a loan.

Payday loans

Payday loans are made to offer immediate access so you can finance to assist individuals succeed from one pay check to the next. Such short-term financing often have high interest rates and you can small repayment attacks. Sometimes, borrowing inspections commonly carried out. Payday loan is a well-known option for people with poor credit results.

Borrowing from the bank Off Household members or a friend

Taking out financing are always encompass paying rates of interest. In the case of tribal and you will payday loans, the attention prices can be hugely high, meaning that you are going to pay off over you borrowed. For those who only need some money otherwise are because of discovered fee in the near future (your profits, for example), and you may shell out that loan right back easily, they ily associate for a financial loan alternatively.

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

4 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

4 × ৳ 50.00  Diapant (Diapar) MSis

2 × ৳ 140.00

Diapant (Diapar) MSis

2 × ৳ 140.00  Clear Complete Active Care | 180 ml

3 × ৳ 220.00

Clear Complete Active Care | 180 ml

3 × ৳ 220.00  Mederma Advanced Plus (Scar Gel) 10gm

2 × ৳ 920.00

Mederma Advanced Plus (Scar Gel) 10gm

2 × ৳ 920.00  Amilin (Tab) 10mg

1 × ৳ 0.85

Amilin (Tab) 10mg

1 × ৳ 0.85  Boost 3X More Stamina Jar | 400 g

2 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

2 × ৳ 390.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

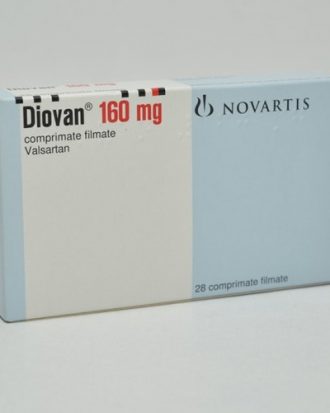

1 × ৳ 450.00  Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Alneed (Tab) 400mg

1 × ৳ 3.00

Alneed (Tab) 400mg

1 × ৳ 3.00  Closeup | 100 g

1 × ৳ 110.00

Closeup | 100 g

1 × ৳ 110.00  Uropass (Cap) 0.4mg

1 × ৳ 10.05

Uropass (Cap) 0.4mg

1 × ৳ 10.05