-

×

Aripra (Tab) 15mg

3 × ৳ 7.00

Aripra (Tab) 15mg

3 × ৳ 7.00 -

×

Crunchos Almond Roasted & Salted 100gm

2 × ৳ 440.00

Crunchos Almond Roasted & Salted 100gm

2 × ৳ 440.00 -

×

Nasal Inhaler Mark 2

1 × ৳ 100.00

Nasal Inhaler Mark 2

1 × ৳ 100.00 -

×

Himalaya Men Pimple Clear Neem (Face Wash) 100 ml

2 × ৳ 275.00

Himalaya Men Pimple Clear Neem (Face Wash) 100 ml

2 × ৳ 275.00 -

×

Suger 1 Kg

1 × ৳ 70.00

Suger 1 Kg

1 × ৳ 70.00 -

×

Himalaya Purifying Neem (Face Wash) 100 ml

3 × ৳ 185.00

Himalaya Purifying Neem (Face Wash) 100 ml

3 × ৳ 185.00 -

×

Allah Shafi Honey (80gm)

1 × ৳ 135.00

Allah Shafi Honey (80gm)

1 × ৳ 135.00 -

×

Aldorin (Tab) 50mg

1 × ৳ 10.00

Aldorin (Tab) 50mg

1 × ৳ 10.00 -

×

Aptin M 50/500mg

2 × ৳ 22.00

Aptin M 50/500mg

2 × ৳ 22.00 -

×

Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00

Schweppes Dry Ginger Ale (Drink) 320ml

1 × ৳ 200.00 -

×

Alneed (Tab) 400mg

4 × ৳ 3.00

Alneed (Tab) 400mg

4 × ৳ 3.00 -

×

Glycephage (Tab) 500mg

1 × ৳ 5.00

Glycephage (Tab) 500mg

1 × ৳ 5.00 -

×

Crunchos Cashew Fried & Salted 200gm

2 × ৳ 710.00

Crunchos Cashew Fried & Salted 200gm

2 × ৳ 710.00 -

×

Carbiroid (Tab) 5mg

3 × ৳ 9.60

Carbiroid (Tab) 5mg

3 × ৳ 9.60 -

×

Boric Acid 100gm

3 × ৳ 55.00

Boric Acid 100gm

3 × ৳ 55.00 -

×

Durex Condom 1o pcs

2 × ৳ 500.00

Durex Condom 1o pcs

2 × ৳ 500.00 -

×

Alatrol (Tab) 10mg

2 × ৳ 3.00

Alatrol (Tab) 10mg

2 × ৳ 3.00 -

×

Clean & Clear Foaming Face Wash 100ml

4 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

4 × ৳ 240.00 -

×

Clear Men Anti-Dandruff | 330 ml

2 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

2 × ৳ 450.00 -

×

Closeup | 100 g

4 × ৳ 110.00

Closeup | 100 g

4 × ৳ 110.00 -

×

Alve (Tab) 60mg

1 × ৳ 5.00

Alve (Tab) 60mg

1 × ৳ 5.00 -

×

Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

2 × ৳ 140.00 -

×

Exforge (Tab) 5/80mg

3 × ৳ 50.50

Exforge (Tab) 5/80mg

3 × ৳ 50.50 -

×

Amisol Gold (Inj.) 500ml

3 × ৳ 401.00

Amisol Gold (Inj.) 500ml

3 × ৳ 401.00 -

×

Ganteal Gel 10gm

1 × ৳ 550.00

Ganteal Gel 10gm

1 × ৳ 550.00 -

×

Migrex (Tab) 200mg

1 × ৳ 10.00

Migrex (Tab) 200mg

1 × ৳ 10.00 -

×

Durex Play Gel 100ml

1 × ৳ 700.00

Durex Play Gel 100ml

1 × ৳ 700.00 -

×

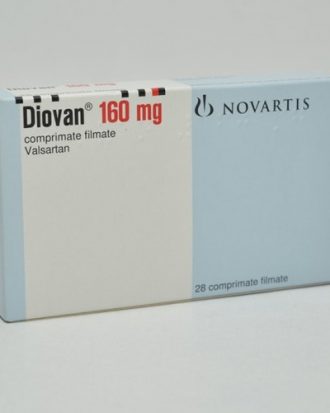

Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00 -

×

Trileptal (Tab) 300mg

1 × ৳ 20.06

Trileptal (Tab) 300mg

1 × ৳ 20.06 -

×

Amilin (Tab) 10mg

1 × ৳ 0.85

Amilin (Tab) 10mg

1 × ৳ 0.85 -

×

Maggi Masala Blast 504gm

1 × ৳ 140.00

Maggi Masala Blast 504gm

1 × ৳ 140.00 -

×

Acme Premium (Juice) 250ml

2 × ৳ 25.00

Acme Premium (Juice) 250ml

2 × ৳ 25.00 -

×

American Hervest Milk (290ml)

2 × ৳ 200.00

American Hervest Milk (290ml)

2 × ৳ 200.00 -

×

Win Boost (Pen)

2 × ৳ 10.00

Win Boost (Pen)

2 × ৳ 10.00 -

×

Alanil (Syp) 50ml

1 × ৳ 1.00

Alanil (Syp) 50ml

1 × ৳ 1.00 -

×

Ameloss (Tab) 5mg

2 × ৳ 100.00

Ameloss (Tab) 5mg

2 × ৳ 100.00 -

×

Adelax (Tab)

2 × ৳ 5.02

Adelax (Tab)

2 × ৳ 5.02 -

×

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00 -

×

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00 -

×

Xeldrin (Cap) 10mg

1 × ৳ 2.00

Xeldrin (Cap) 10mg

1 × ৳ 2.00 -

×

Strepsils Honey & Lemon

1 × ৳ 13.00

Strepsils Honey & Lemon

1 × ৳ 13.00

Subtotal: ৳ 11,805.25