What are the results If the Loan Was Rejected?

For many who sign up for financing and also denied, understanding the reason behind the brand new assertion can help you influence their 2nd procedures and ways to improve your probability of approval 2nd date.

In this article:

- Understanding Why The loan Is actually Refuted

- Getting Rejected Cannot Hurt Your credit rating

- Getting a loan For those who have Bad credit

- How to build Their Borrowing from the bank Before applying for the next Loan

If you have been recently rejected that loan, you are not alone. Knowing the reason why the loan try refused can help you influence your following procedures and you can replace your odds of getting recognized the next time you was. Even if the sting regarding denial may still getting new, this is what can help you.

Skills As to why The loan Was Rejected

Whether your application for the loan try denied, the lender will be sending you what’s titled a bad action page which explains as to why.

Your credit report plus earnings certainly are the significant reasons a bank could possibly get refute your application, but with regards to the situation, there is certainly most other explanations also. Below are a few of one’s prospective circumstances that may join your denial:

Credit

Your credit report and you will credit scores is actually number 1 facts lenders thought when you submit a software. Very bad products remain on your credit reports to own 7 many years, however their effect on your own borrowing from the bank generally reduces over the years.

installment loans in New Mexico

If loan providers come across any high bad products on the credit report or other red flags, they may determine one, since a borrower, you may be also risky to accept at this timemon credit file facts that will apply to their rating and you can potentially subscribe to a denial include:

- Case of bankruptcy

- Foreclosure

- Range account

- Unpaid money

- Large mastercard balances

You may end up being refuted if your credit history is leaner compared to the lender’s minimum specifications. To quit which of taking place again, make sure you see the credit scores and look around to have loans which might be targeted to your borrowing from the bank variety.

Income

Should your financial denies the loan software centered on earnings, a few activities could be the probably offenders. The foremost is that the money will not meet the lender’s minimal needs. Because most loan providers don’t upload this article, it’s difficult to learn in the event the money is actually satisfactory so you’re able to satisfy their standards unless you inquire otherwise incorporate.

Additional reasoning would be the fact the debt-to-income ratio (DTI) is actually large. You might calculate accurately this ratio from the breaking up your own overall minimal monthly personal debt repayments by your monthly gross income.

Most loan providers need a great DTI of 50% otherwise faster, and you may mortgage brokers might go as little as 43% if you don’t lower. If the a is too high, lenders you will see you just like the not able to manage an extra mortgage payment. To change your chances of delivering approved next time your use, manage paying off several of your financial situation-otherwise boosting your earnings.

Most other Things about Assertion

If you find yourself your credit and you can income could be the number one facts lenders think, they don’t share with the entire story. As such, you may be denied predicated on other reasons, instance:

When you might not have enough immediate command over these items, make reasons surely and you will hold back until you’re in a much better updates to apply once more.

Providing Denied Doesn’t Harm Your credit score

Once you complete a credit software, the lender otherwise collector will generally run a painful inquiry on the no less than one credit history, which will be notated in your records. For many people, a painful inquiry knocks less than four points off their borrowing from the bank score, but you to little dip will not last much time-1 year no more than.

Clear Complete Active Care | 180 ml

2 × ৳ 220.00

Clear Complete Active Care | 180 ml

2 × ৳ 220.00  Carex Classic Condoms | 3 pieces

5 × ৳ 35.00

Carex Classic Condoms | 3 pieces

5 × ৳ 35.00  Ameloss (Tab) 5mg

2 × ৳ 100.00

Ameloss (Tab) 5mg

2 × ৳ 100.00  Closeup | 100 g

2 × ৳ 110.00

Closeup | 100 g

2 × ৳ 110.00  Prosma (Syp) 100ml

1 × ৳ 60.00

Prosma (Syp) 100ml

1 × ৳ 60.00  Exforge (Tab) 5/80mg

1 × ৳ 50.50

Exforge (Tab) 5/80mg

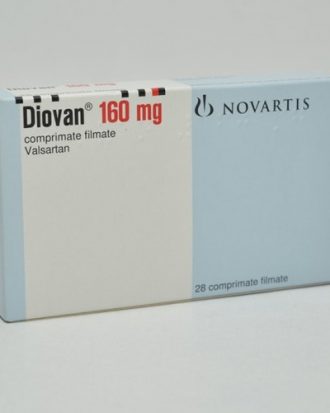

1 × ৳ 50.50  Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Win Boost (Pen)

1 × ৳ 10.00

Win Boost (Pen)

1 × ৳ 10.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00  Mother's Smile 4 Fruits (Cereal) 400gm

1 × ৳ 450.00

Mother's Smile 4 Fruits (Cereal) 400gm

1 × ৳ 450.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00  ACI Savlon Antiseptic | 56 ml

1 × ৳ 32.00

ACI Savlon Antiseptic | 56 ml

1 × ৳ 32.00