Subtotal: ৳ 1,220.06

LightStream’s application and you may investment techniques is actually completed on the web. The business will not reveal credit history or income conditions private fund, but it does believe that they approves borrowers with lots of ages out-of credit rating, reliable earnings, property and you will a reputation into the-big date repayments.

That which we such as

- Rates Overcome program: When you are acknowledged for another unsecured loan out-of another financial at a diminished speed, you could potentially establish this type of terms so you’re able to LightStream, and it’ll beat the speed by 0.1%.

- Financing Sense Guarantee: LightStream provides you with $a hundred if you’re not totally happy with the loan experience and you can fill out a questionnaire.

- Zero origination percentage: LightStream fees no origination payment – or other costs, particularly late charges or a prepayment punishment.

What you should thought

- $5,100 minimum loan requirements: Minimal financing needs are $5,one hundred thousand, that’s greater than you need – also it can feel an awful idea so you can acquire more required.

- Charge or Credit card charge card expected: LightStream’s online app says you really must have a valid Charge or Mastercard mastercard to possess confirmation objectives before you can found mortgage funds. Their card actually recharged.

- No mobile phone service: LightStream will not render customer care by phone; you must current email address having answers to issues.

What folks state

LightStream have essentially beneficial analysis into all of our web site, that have that reviewer from Fl praising the business’s customer service and you will choice.

“Lightstream couldn’t end up being any more user-friendly and you can customers-inspired!” she said. “They plant a tree for each and every financing! They supply lots of cost options and allow you to definitely change percentage time and matter when you should make it a great deal more convenient.”

Our better selections enjoys good choices, but the ideal financial to you depends on your circumstances and you will concerns. LightStream, such as for example, has the lower creating ount. Read the desk lower than to own extremely important activities out of investigations between our finest selections.

How to get an informed Annual percentage rate into the that loan

An educated (and lowest) APRs are booked to possess consumers which have advanced borrowing from the bank, which may be defined as a get from 800 or even more, however it is you can locate that loan even although you has less-than-top borrowing from the bank.

To keep towards the borrowing from the bank will set you back, search credible loan providers that offer reasonable pricing having pair fees. Before you apply to have an unsecured loan, you should demand a recent duplicate of your credit file and look they getting problems and discrepancies that may negatively connect with their get.

You’re eligible to that totally free credit history each year away from for each of your own about three biggest credit bureaus (TransUnion, Equifax and Experian) – see annualcreditreport to locate payday express Taylorville a copy of yours. Check with your charge card company or lender to own access to your score.

If you find that the borrowing was below greatest, you might focus on boosting your rating before applying for funds. Work on using your own costs punctually and keeping your borrowing from the bank usage lowest.

Faqs

How to submit an application for a personal loan regarding a financial is by using the website. It is possible to phone call or visit an actual physical lender department if the you’d like to use truly. There is certainly advantageous assets to making an application for a consumer loan away from the financial institution where you keep a checking or savings account, like promotions.

The average interest to your a personal loan is ranging from ten% and you can 28%. The rate of interest utilizes facts like your credit score, your income, the newest percentage term, the lending company and other activities.

Summary: How to pick that loan for those who have a good credit score

Typically, for those who have a good credit score, just be able to safer a reduced speed towards the a good consumer loan. Since you research loan choice, think about the history of the lending company, the convenience out-of software, how fast you can aquire loans and you may people fees you can also result in. Make sure to examine also provides regarding multiple loan providers prior to their decision.

- Just several repayment conditions readily available: Do well only even offers a few cost terms and conditions: 36 months or 5 years. If you are looking to own a smaller otherwise long run, you’re going to have to consider another financial.

Unsecured loans produced using Upgrade ability Annual Fee Cost (APRs) from 8.49%-%. The signature loans possess a-1.85% to eight.99% origination fee, that is subtracted on the financing proceeds. Reasonable prices require Autopay and you will paying a fraction of existing financial obligation yourself. Fund function repayment regards to twenty four to help you 84 days. Including, for many who located good $ten,000 mortgage that have a thirty six-month identity and you will a great % Annual percentage rate (with an effective % yearly interest and you will a beneficial 5% one-day origination fee), you might located $nine,500 on the membership and would have a required payment away from $. Along the life of the loan, your payments create total $twelve,. The latest Apr on your own financing is generally high otherwise all the way down and your loan now offers may not have multiple name lengths available. Real rate utilizes credit history, borrowing incorporate history, financing term, or other items. Late payments or then charges and you may charge could raise the costs of the fixed rate mortgage. There’s absolutely no percentage or penalty to own paying down a loan early. Personal loans issued by the Upgrade’s financial partners. Details about Upgrade’s financial people can be obtained in the

Once your application is recognized, possible signal the mortgage data and you may connect your money to help you have the money. Fund will likely be deposited within this 3 or 4 working days.

The loan terms, also ount, title length, plus borrowing profile. Excellent borrowing is needed to be eligible for reasonable pricing. Rates try quoted that have AutoPay write off. AutoPay dismiss is available prior to loan capital. Cost versus AutoPay is actually 0.50% circumstances highest. Subject to borrowing from the bank approval. Requirements and you may restrictions pertain. Reported prices and you can conditions are at the mercy of alter with no warning. Percentage example: Monthly premiums to possess an effective $10,one hundred thousand mortgage from the step 3.99% Apr that have a phrase out of 4 years carry out lead to 48 monthly payments away from $. Truist Lender try an equal Property Bank. © 2023 Truist Economic Agency. Truist, LightStream, therefore the LightStream sign was services marks off Truist Financial Agency. Any kind of trademarks may be the assets of its particular people. Lending services provided by Truist Bank.

LightStream was a department off Truist, a bank formed from the merger out-of SunTrust Bank and you will BB&T. It has personal loans for assorted aim, plus do it yourself, car instructions, recreation, family existence and you will debt consolidation. It has got aggressive costs on finance to $one hundred,100000, a fulfillment ensure and you may a speed-beating program. You can implement on the internet and maybe rating same-day financial support.

Mederma Advanced Plus (Scar Gel) 10gm

Mederma Advanced Plus (Scar Gel) 10gm  Clean & Clear Foaming Face Wash | 50ml

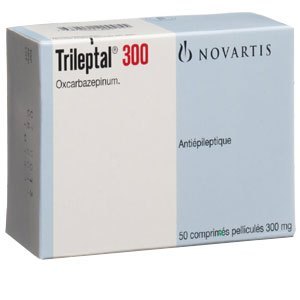

Clean & Clear Foaming Face Wash | 50ml  Trileptal (Tab) 300mg

Trileptal (Tab) 300mg