Conclusion: Who is The essential Credible Payday loans online Direct Lender?

- Just what are a number of the criteria needed for you to meet the requirements for a loan?

Having prospective borrowers so you’re able to qualify for online pay day loans, they have to see what’s needed. They become being eighteen age and you will significantly more than, a permanent U.S. citizen, otherwise an excellent U.S. citizen. Additionally, the new borrower need a constant monthly earnings that they may establish up on demand.

But payday loans same day they are just basic standards expected when trying to get one version of unsecured loan

As well, the consumer should provide a valid current email address, domestic contact number, and works phone number. However, appointment most of these requirements cannot ensure that you will get good lender.

- Exactly what are the drawbacks from payday loans online?

One of the biggest disadvantages from an instant payday loan are one a top-interest rate may be charged. It is because these finance was lent because of the those with crappy fico scores and are also experienced a top chance. Due to this fact, large interest levels are often billed. It is typical getting lenders so you can charge its individuals a great 391% Annual percentage rate or even dos,290%.

Some other drawback is that really individuals don’t see its monthly expenditures. If you can’t pay for book and other costs, then borrowing a quick payday loan might be some other fret for repayments. Therefore, if you don’t have money two pay off inside those people few days, it will increase the amount of be concerned.

For once, the aforementioned-chatted about businesses are the latest legitimate cash advance lead on the web lenders we have in the industry. Note that an online payday loan are an instant and you will sufficient supply out-of funds to work through unforeseen requires. Yet not, he has got terrible effects, especially when talking about unreliable and you may illegitimate payday loan loan providers.

However,, hopefully, there are one of the four the latter pay day loan lenders to possess legitimate, sincere, and you will upfront financial help features. Relax knowing to use some of the web sites while they enjoys come precisely processed and you can determined to-be worthwhile. not, be sure you analysis research in advance of taking loan offers of lenders. Look for APRs, terms of mortgage fees, lender allow, on the web reviews, and so many more factors to stop in case the bank is good to you according to your financial preferences.

Zero borrowing checks: Of numerous borrowers you should never availability finance because of borrowing troubles. It is because extremely financial firms is not able to offer funds if you do not provides a very clear credit financial history. Yet not, MoneyMutual promises financing acceptance instead of powering borrowing monitors, and therefore boosts the odds of protecting financing even after poor credit ratings.

Less than perfect credit Loans: Which stress represent exactly what the business name is short for. And therefore, BadCreditLoans is fantastic some one whose poor credit history inhibits her or him off being able to access less than perfect credit financing. Although not, when you have borrowing from the bank dilemmas, you should search borrowing guidance to quit the brand new adverse risk of bringing funds and possess a bad credit score.

Lastly, payday loan are due easily, usually inside a fortnight

Like other lenders within this publication, PersonalLoans doesn’t try to be a loan provider. Alternatively, it link potential individuals which have an extensive circle from credible loan providers. If you find dilemma-free and punctual financial assistance, this company try a power so you can think with. What’s more, the financial help attributes they offer was totally free yet , quality.

You could acquire reasonable fund anywhere between $500 in order to $ten,100 using CashUSA. The organization assurances everyone can availableness financing despite credit scores. They compels lenders so you’re able to situation fund according to borrowers’ suggested need, a great virtue for many who is fuzzy from delivering finance away from traditional lenders for example financial institutions.

- Credibility and you may visibility: Very loan lenders, particularly online pay-day lenders, aren’t usually open to their customers. He’s invisible conditions and terms that you will after bear costs after you break, regardless of not being alert. Due to that, i picked sincere and you may upfront lending companies. All of our recommended cash advance lenders possess clear terms and conditions one you’re enlightened on the before carefully deciding to obtain with these people.

It’s good to know payday loans online commonly financial activities; alternatively, private loan providers bring them. The latest fund will come in the convenient whenever one needs quick dollars. Particularly, while in the times of disaster, people end up credit payday loan.

Thank goodness, you can nevertheless rating an instant payday loan even though you try not to possess a bank account. The lending company usually still approve your loan. In such cases, the borrowed funds continues are often delivered to your inside the dollars or debit card otherwise might be delivered to the email address because the an effective view. Those who don’t have bank account is query their loan providers hence step to consider.

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00  Boost 3X More Stamina Jar | 400 g

2 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

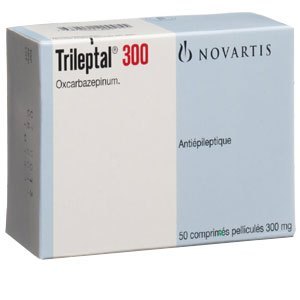

2 × ৳ 390.00  Trileptal (Tab) 300mg

1 × ৳ 20.06

Trileptal (Tab) 300mg

1 × ৳ 20.06  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00  Closeup | 100 g

1 × ৳ 110.00

Closeup | 100 g

1 × ৳ 110.00