Biden cancels $1 million away from college loans

Chairman Joe Biden launched Wednesday you to their administration have a tendency to terminate $ten,000 inside education loan financial obligation to own federal consumers and you may $20,one hundred thousand getting Pell Grant receiver getting lower than $125,000 a-year.

Brand new enough time-forecast statement arrives 7 days before pandemic pause with the beginner financing costs is scheduled to finish. Biden was extending you to definitely stop from the avoid of the year, which will surely help all the borrowers, just those eligible for your debt forgiveness, although administration is alerting this is basically the last expansion and you may consumers will be decide to resume costs inside January.

Your debt forgiveness try capped in the $20,000 having Pell Offer recipients and you will $10,100000 towards the almost every other forty % from government individuals. To be considered, people need received below $125,100 and property below $250,one hundred thousand in both new 2020 or 2021 taxation ages, predicated on elderly management authorities just who described the details of bundle within the a background label that have journalists.

The fresh recovery are estimated to benefit 43 mil federal student loan consumers, 20 billion out-of just who can get its obligations completely canceled, the latest officials told you. Current students meet the criteria on save, having dependents’ qualifications considering their parents’ income.

Among administration’s desires toward debt forgiveness is always to assist thin the new racial wide range gap. The typical Black colored debtor can find its financing harmony cut in 1 / 2 of, with one out of all five Black individuals watching the obligations canceled entirely, brand new authorities told you.

“All of this form people will start so you’re able to in the end crawl from lower than one slope off obligations, to obtain on top of the lease in addition to their resources, in order to ultimately consider to shop for a home otherwise carrying out a family otherwise undertaking a business,” Biden told you from inside the feedback regarding the Light Household. (more…)

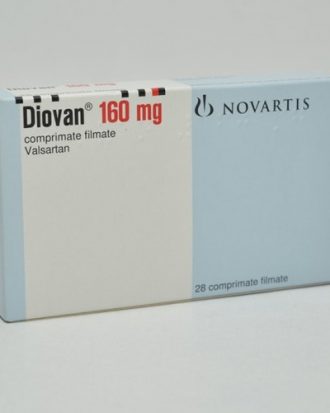

Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Clean & Clear Foaming Face Wash | 50ml

4 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

4 × ৳ 140.00  Closeup | 100 g

4 × ৳ 110.00

Closeup | 100 g

4 × ৳ 110.00  Carex Classic Condoms | 3 pieces

5 × ৳ 35.00

Carex Classic Condoms | 3 pieces

5 × ৳ 35.00  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

5 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

5 × ৳ 50.00  Boost 3X More Stamina Jar | 400 g

8 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

8 × ৳ 390.00  Clean & Clear Foaming Face Wash 100ml

7 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

7 × ৳ 240.00  Clear Men Anti-Dandruff | 330 ml

7 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

7 × ৳ 450.00  Amilin (Tab) 25mg

1 × ৳ 1.75

Amilin (Tab) 25mg

1 × ৳ 1.75