Oregon and you will Virginia do not ban pay day loan entirely, but they cover APRs from the thirty-six percent

The brand new regulations plus prohibited financial institutions by using inspections and other measures from bank-account accessibility as the collateral

However, one of several 50 claims, high priced lending persists because of loopholes and out-of-condition lenders’ power to from time to time avoid restrictions. Pay check credit in the Virginia provides a robust instance of just how which happens. Virginia condition legislation, yet not, allows one or two fees together with rates, and thus, there is certainly an average yearly speed off 282 percent during the Virginia, even after the thirty-six % cover. In addition, inside the Kansas, pay-day loan providers were able to recharter on their own and you may add charges in payday loans Missouri order to dress brand new country’s voter-recognized 28 percent Annual percentage rate cover.

Almost every other strategies to combat pay day lending was removed at the local top. Taking new risky impact out of payday lending towards reduced-income communities, il launched the zoning guidelines so you can limit the quantity of payday-lending towns and cities and offered brand new energies on the town regulatory institution in this field. Because of a lack of state-height protections, equivalent zoning ordinances keeps passed from inside the Ca towns such San Francisco, Oakland, Oceanside, and you may Sacramento, ca. Metropolises within the twenty four almost every other says have also enacted zoning limits.

Even with these services, the reality is that most currently vulnerable some one and you can their families are now living in says and you will localities in which you can find limited if any monitors for the pay day lending. (more…)

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00  Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00  Closeup Ever Fresh Anti Germ Toothpaste | 45 g

1 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

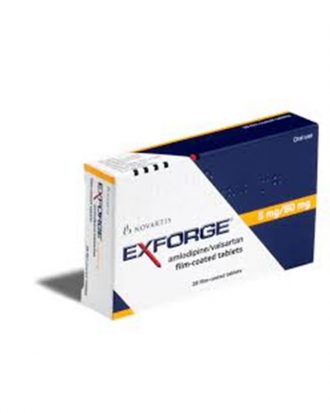

1 × ৳ 50.00  Exforge (Tab) 5/80mg

1 × ৳ 50.50

Exforge (Tab) 5/80mg

1 × ৳ 50.50