Subtotal: ৳ 665.00

It is the beginning of November. All of a sudden, store window is actually full of tinsel, the newest high street is much like a chaotic 100 % free-for-all the together with exact same joyful sounds begin to feel starred ad nauseum. Enjoy it or perhaps not, Christmas is merely on the horizon, and with that, we are all tempted (or forced) to overspend and you can overstretch our earnings. Which have functions, products and you will presents to fund, we could possibly wake up on the other hand of brand new Season which have an awful monetary dangle over.

Throughout the wake of recent reports you to definitely pay check financial QuickQuid entered management on the twenty-five th October, most people are once more debating brand new relative convenience in which borrowing is be obtained regarding pay day loan providers, even though the “traditional” economic lenders like banking companies and you may strengthening communities is actually reluctant otherwise unable to provide to own regulating factors.

These organizations often have strict assistance towards that will borrow, considering their capability to repay. Many of these choice try tricky and you can end in men and women currently when you look at the personal debt being actually deeper embroiled in the course away from subsequent highest attention, borrowing from the bank to satisfy financing costs or any other monthly duties.

It gave a crucial insight into the new cash advance field, reflecting that 53% out-of payday loans consumers as part of the studies revealed that they put the financing to possess bills (such market and you will power bills).

The same analysis questioned whether or not payday loans people had educated people financial hardships otherwise borrowing dilemmas within the last five years. The study discovered that:

- 38% from users advertised a detrimental impact on its credit rating

- 35% got generated plans having loan providers to pay off arrears

- 11% got educated a state judge reasoning

- 10% was went to by the possibly an excellent bailiff otherwise personal debt collector

In fact, all in all, 52% out of people interviewed as part of the investigation revealed that it got experienced one or more of them personal debt-relevant problems over the last five years.

Because these situations is actually mirrored toward borrowing records, the capacity to obtain borrowing with increased aggressive interest rates has been hard, eg with a high highway lenders. Consequently, a lot of people turn-to pay day loan as a way of fabricating stops see.

Callum talked so you can consumeradvice.scot from the their knowledge which have pay day loan providers after being refuted a beneficial personal bank loan and charge card with his lender due to perhaps not fulfilling the latest affordability requirements set out regarding the application techniques.

It was simply of the skills their rights as the a customer and comprehending that the fresh cash advance providers must not enjoys in the first place authorised their financing which he was able to get back control

“My personal earnings have always been lower than my payday installment loans in New Mexico friends. They could subside having weekends and you may getaways versus as often considered the costs involved. For my situation, being forced to cut of these luxuries, while the investing my monthly bills means and also make a great amount of sacrifices and you may life cheaper.”

Callum chatted about brand new cycle off borrowing to settle their present responsibilities as well as how that it affected through to their state getting months at the a good time.

“I would reduced the newest aircraft and holiday accommodation regarding by saving, however the spending-money is challenging for my situation…Ibiza actually an affordable spot to go to and i also lent ?800 to your few days. It was most of the really well and you may great at enough time away from the holiday, nevertheless the pursuing the day the latest realisation strike me your month-to-month costs was in fact so high priced, nearly ?270 per month, and also in the long-title, trying to repay nearly twice the thing i had borrowed whenever expenses this more than half a year.”

Therefore, the exact opposite for many is always to reach out to much easier-to-receive cash advance, which have high interest levels, ultimately causing a much bigger long-name fees

Callum needed to remove various other step 3 cash advance and come up with the latest monthly duties and you may rapidly receive himself digging deeper into the personal debt.

Abecab (Tab) 5/40mg

Abecab (Tab) 5/40mg  Clear Men Anti-Dandruff | 330 ml

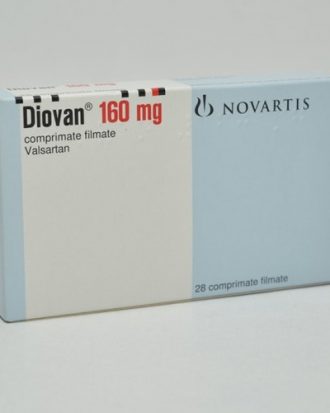

Clear Men Anti-Dandruff | 330 ml  Diovan (Tab) 160mg

Diovan (Tab) 160mg  Clean & Clear Foaming Face Wash | 50ml

Clean & Clear Foaming Face Wash | 50ml