A timeless strategy regarding personal credit loan providers could have been bringing earliest-lien label loans to center-industry organizations backed by private-collateral sponsors

Recently, we’ve got viewed further pairings between option resource professionals and you may insurers, the spot where the insurer can provide a supply of perpetual investment to your lending platform. Solution asset executives set illiquid credit possessions regarding the get-and-keep profiles out-of insurance companies to make this new illiquidity premium. Eg, advantage manager Apollo All over the world Administration Inc. manages considerably every one of annuity vendor Athene Carrying Ltd.’s possessions, that property show a significant display (up to 40%) out-of Apollo’s possessions below management. Earlier this year, Apollo established their plan to mix having Athene.

When you find yourself personal personal debt funds was basically directed generally toward institutional buyers, multiple high house professionals has recently removed procedures to start categories out of personal personal debt funds so you can qualified private investors. Since the individual personal debt possess traditionally already been a purchase-and-hold advantage, it might seem unwell-suited since a secured item in the an effective redemption-qualified loans. However, this risk was lessened whether your financing possess sufficient safety set up which could prevent investor redemptions out-of ultimately causing pressed conversion process from illiquid individual obligations.

Since BDC credit is generally highly focused on individual borrowing from the bank industry, social evaluations on BDCs also have a slim glance at toward that it individual market

Whether or not separate otherwise working as an element of a bigger credit program, BDCs was main participants from the individual borrowing markets because the lead credit is their key business. Although many of BDCs that individuals safety is ranked ‘BBB-‘, the majority are apparently high that have apparently a great underwriting track info; reduced BDCs and additionally people who have alot more mixed underwriting info tend to go unrated.

This region enjoys probably come to explain personal debt’s center providers. This key organization is developing, with a few loan providers championing “unitranche” formations one to eliminate the state-of-the-art money structure out-of earliest- and you can second-lien loans in favor of an individual studio. The fresh unitranche structure generally speaking have a higher yield than a good syndicated first-lien financing, generally dominating a paid out-of fifty-one hundred bps more than antique elderly financings to pay loan providers having improved risk. not, this may promote individuals less mediocre price of financing more than the complete personal debt framework.

Having fewer lenders employed in one purchase, borrowers commonly functions a lot more closely making use of their private loans loan providers. Consumers may benefit while the purchases can be executed more easily, in accordance with so much more confidence away from prices, than simply with a huge syndicate regarding loan providers. Furthermore, the pace of which amendments had been strike in the personal financial obligation areas due to the fact pandemic unfolded shows so it relationships.

Entry to Covenants: Private personal debt try a large part of your loan business in which covenants are well-known. Very selling possess a minumum  of one, and that will bring particular safeguards into financial. Particularly, a critical portion of the enterprises by which i carry out borrowing from the bank prices has actually economic-maintenance covenants. Although not, the presence of covenants really does frequently subscribe to more regular non-payments (particularly choosy non-payments) and exercising out of personal consumers (while we noticed towards the spike into the selective non-payments within the 2020).

of one, and that will bring particular safeguards into financial. Particularly, a critical portion of the enterprises by which i carry out borrowing from the bank prices has actually economic-maintenance covenants. Although not, the presence of covenants really does frequently subscribe to more regular non-payments (particularly choosy non-payments) and exercising out of personal consumers (while we noticed towards the spike into the selective non-payments within the 2020).

Closer Dating Ranging from Bank and you may Borrower: Individual debt remains most relationships-passionate

Post-Standard Workouts: That have a lot fewer lenders, the whole process of exercising a personal debt design in the event out-of a standard could be less and less expensive to possess an exclusive debtor. In addition, much easier financial obligation structures (like unitranche purchases) remove the difficulty away from competing obligations classes that can slow a reorganizing. This type of activities subscribe recovery rates getting individual financial obligation that are usually high normally than those into broadly syndicated finance.

Illiquidity: That is a key likelihood of private personal debt, because these devices usually commonly replaced during the a vacation field-although this get change-over day if for example the business in terms out of volume and you can quantity of users is growing. Due to this fact, there is restricted markets development and you may loan providers need have a tendency to approach the fresh new market to the willingness and you may capacity to contain the obligations to help you readiness. Eg, customers off private debt tend to be existence insurance providers which might be better-positioned to take on the new liquidity risk of it loans having the brand new get-and-keep characteristics of the profiles. Meanwhile, private obligations finance aimed toward personal buyers will get perspective a danger when they susceptible to redemptions that could cascade so you’re able to forced advantage conversion. Individual debt’s illiquidity you can expect to complicate matters for an investor trying to good rash get off.

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00

Clear Men Anti-Dandruff | 330 ml

1 × ৳ 450.00  Clean & Clear Foaming Face Wash | 50ml

4 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

4 × ৳ 140.00  Carex Classic Condoms | 3 pieces

1 × ৳ 35.00

Carex Classic Condoms | 3 pieces

1 × ৳ 35.00  Boost 3X More Stamina Jar | 400 g

1 × ৳ 390.00

Boost 3X More Stamina Jar | 400 g

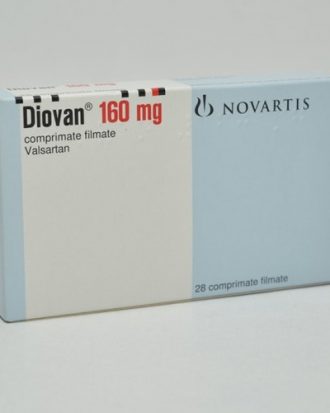

1 × ৳ 390.00  Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00  Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00

Clean & Clear Foaming Face Wash 100ml

1 × ৳ 240.00