-

×

Abecab (Tab) 5/40mg

1 × ৳ 18.00

Abecab (Tab) 5/40mg

1 × ৳ 18.00 -

×

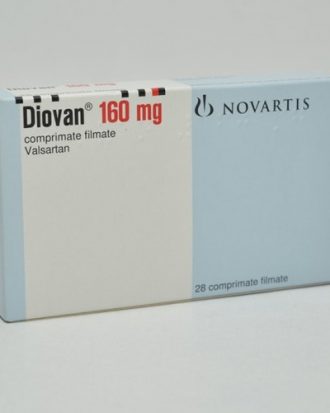

Diovan (Tab) 160mg

1 × ৳ 57.00

Diovan (Tab) 160mg

1 × ৳ 57.00 -

×

Clear Complete Active Care | 180 ml

1 × ৳ 220.00

Clear Complete Active Care | 180 ml

1 × ৳ 220.00 -

×

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00

Closeup Ever Fresh Anti Germ Toothpaste | 45 g

2 × ৳ 50.00 -

×

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Clean & Clear Foaming Face Wash | 50ml

1 × ৳ 140.00

Subtotal: ৳ 535.00